2025 Recap: Investing ideas, lessons and Predictions for 2026

2025 rewarded patience over prediction. In this recap, I review portfolio highlights, market lessons, blog growth, and share my outlook for 2026 - focusing on fundamentals, value, and long-term investing strategies.

The year behind us rewarded patience more than prediction. 2025 turned out to be a strong year for both value and technology investors, supported by strong markets and improving business fundamentals. For me, it marked the first year with portfolio returns exceeding 35% year-to-date; a result influenced not only by my decisions, but, also by favorable market conditions. With that context in mind, I wanted to write a concise recap of what shaped this year: how the market evolved, how my portfolio changed, and how my thinking as an investor developed along the way. I’ll also share my outlook for 2026 and the ideas I have for further building my presence and work online, always with a focus on long-term value rather than short-term outcomes.

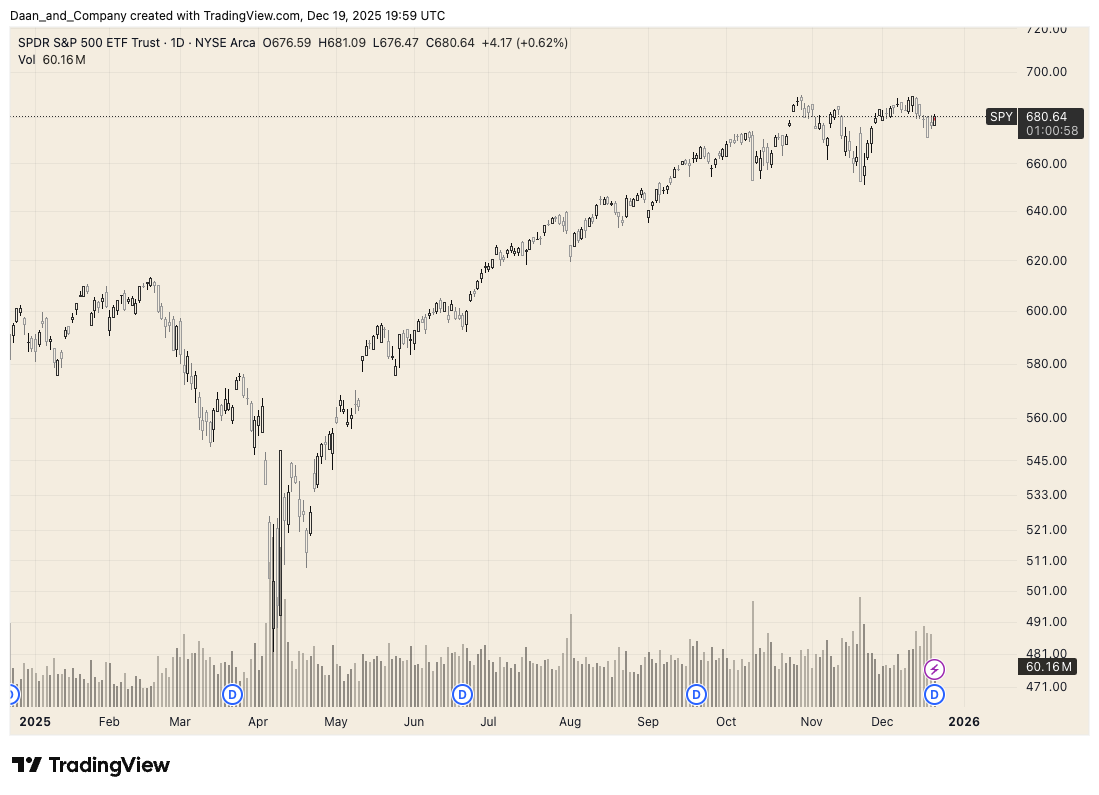

From Uncertainty to New All-Time Highs

Any review of the past year would be incomplete without mentioning the United States elections. Trade tensions and tariff-related concerns dominated the first half of the year, creating significant volatility and putting pressure on even the strongest businesses. It was difficult to watch high-quality companies decline in price while uncertainty raised the question of whether this was a temporary disruption or a lasting shift in the investment landscape. As the year progressed, markets stabilized, confidence gradually returned, and major indices moved on to new all-time highs. Today, while challenges remain, the strategic direction of the world’s most influential economy is clearer, allowing investors to focus once again on fundamentals rather than short-term political noise.

From Fundamentals to Economic Moats: Stock Picks in 2025

Looking back at some of the better decisions discussed on this blog, I can say that several conclusions drawn from fundamental analysis played out well. Companies such as Google, Apple, and Nvidia were covered during the year, and these businesses ultimately became key drivers of the broader market’s move to new all-time highs. At the same time, my focus remained on companies that have yet to deliver meaningful returns but continue to hold a place in my portfolio. ARM and Pinterest remain below my intrinsic value estimates, and I plan to reassess their fundamentals in the first quarter of 2026.

While timing inevitably plays a role in investing, one decision that stands out is my investment in Mercedes-Benz. Despite weaker-than-usual fundamentals, the investment thesis was based on market perception, brand strength, and customer loyalty—elements of an economic moat that are difficult to quantify. The outcome reinforced my belief that valuation is not only about numbers, but also about understanding behavior, sentiment, and long-term brand value.

In future I plan to increase the proportion of stable, blue-chip stocks in my portfolio. While my current holdings continue to maintain their intrinsic value, the goal is to reduce overall exposure to the technology sector and diversify into other areas. I will also focus on building positions in companies with steady growth and reliable dividends, combining stability with long-term value creation.

Blog Growth and Social Media Presence

Over the past year, I increased the consistency of my blog publishing and focused on building a more structured platform for sharing investment ideas. One of the key additions was the Watchlist page, where I periodically document valuations and observations on companies I follow closely but may not yet have the time to cover in full articles. Alongside the blog, I became more active on social media - specially on X - as a way to engage in ongoing market discussions and test ideas in a more immediate format. Looking ahead, I plan to continue writing more regularly in the coming months, with a strong emphasis on clarity, discipline, and long-term thinking.

Looking Forward to 2026

Looking ahead to the coming year, I expect markets to become more volatile and, at times, more unpredictable than they have been recently. Narratives around a potential recession and a possible correction in parts of the AI-driven market remain present in the minds of many investors, contributing to a sense of fatigue rather than clarity. At the same time, global uncertainties persist—from the ongoing war in Ukraine, to tensions in the Middle East, and the increasingly complex relationship between China and the United States.

Despite these challenges, my long-term view remains constructive. History has shown that markets are capable of advancing even amid geopolitical and economic uncertainty, provided that underlying businesses continue to grow and adapt. In that context, I believe there is a strong possibility that the S&P 500 will stand at higher levels by the end of 2026 than it does today—not because risks have disappeared, but because innovation, earnings, and long-term value creation tend to prevail over time.

Thank you for reading and being part of this journey. I wish you a happy, healthy, and successful New Year.

If you enjoy this blog, feel free to subscribe (it’s free), leave a comment, or reach out anytime by email or on X. I’m always happy to connect and exchange ideas - see you in the year ahead.