A Deep Dive into Netflix's Q3 Revenue Growth and Global Monetisation Strategy

Netflix is cementing its leadership in the streaming wars. With Q3 2025 financial report they are showing their strength even in unexpected events.

I have a rule that I usually don't invest in a company's stock unless I consume or use their product in my own life. With Netflix, however, I'm willing to make an honest exception.

This is a well known company whose goal, in their own words, is simple: to entertain the world. They compete in one of the most difficult industries, and for now, they're clearly ahead in many key areas. Thanks to their subscription model, surprisingly big competitive moat, and users who are so loyal they act as brand ambassadors, Netflix is perfect addition to my portfolio.

Financial Performance in Q3 2025

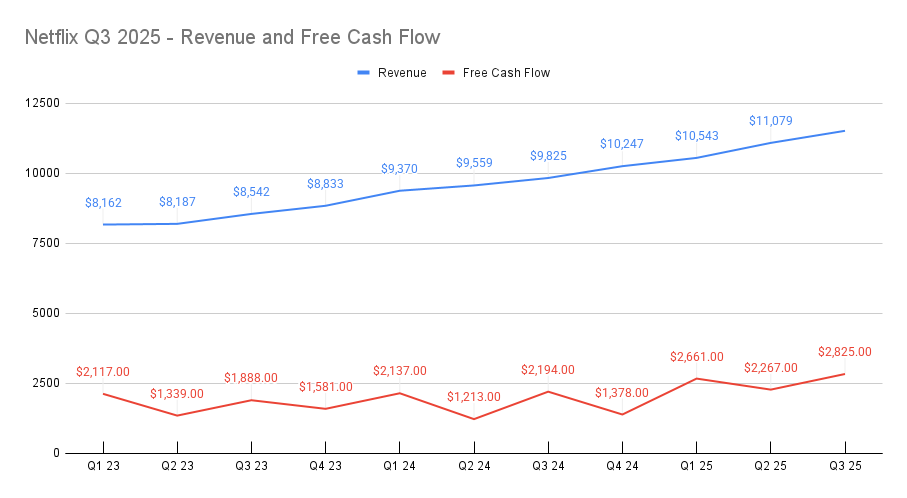

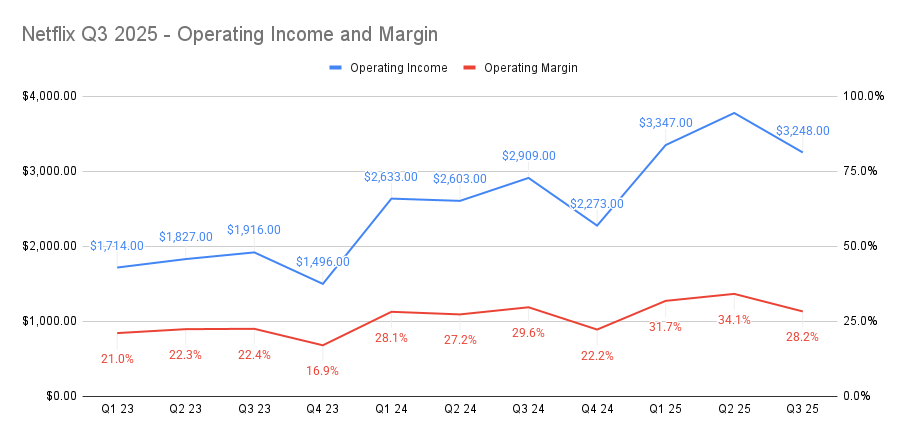

Netflix reported robust revenue growth of 17%, which was in correlation with their guidance. Concurrently, the reported Operating Margin (OM) came in at 28%, trailing their 31.5% forecast. The main reason for this miss was a one-time, non-regular expense connected to an ongoing dispute with Brazilian tax authorities. While many investors don't like these kinds of "surprises," I believe we need to grant Netflix some breathing room. They had previously explained this potential cost in their 10-K papers, and we knew that these costs would materialise; we just didn't know the exact timing.

At the same time, the company achieved its biggest-ever quarterly Revenue while also significantly increasing its Free Cash Flow (FCF) to a record $2.8 billion. This is generally a very strong indicator of financial health, operational efficiency, and future value creation.

Many investors are confused by the Operating Margin guidance for the next quarter, which is set at 23.9%. This confusion comes from the idea that all quarters should have similar operating margins, where any decrease is seen as a sign that something is going wrong. However, for Netflix, Q4 is always the worst quarter for Operating Margin. If this guidance is correct, a 23.9% OM would actually be the best Q4 margin the company has ever achieved, representing almost two percentage point improvement year-over-year.

Surprising Netflix Share TV Time in the US and UK

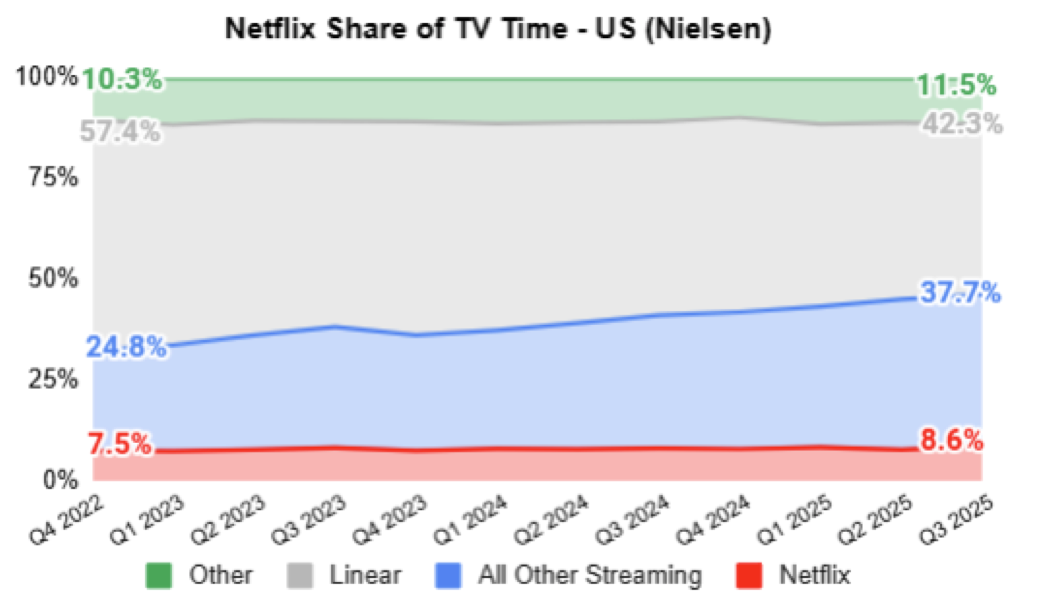

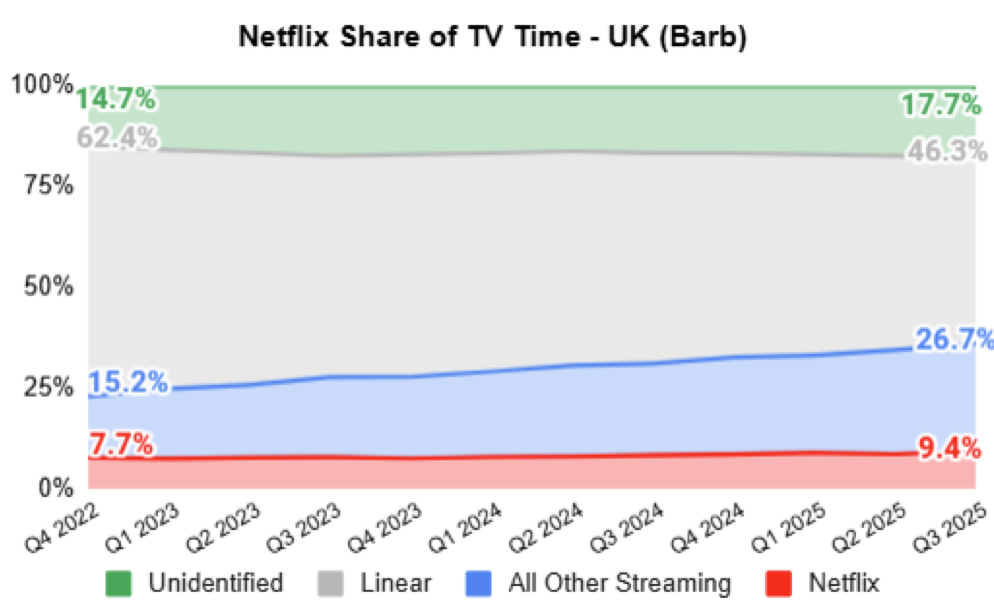

The most recent report also shows Netflix's trajectory in terms of audience engagement by presenting Share TV Time metrics in two critical markets: the US (8.6%) and the UK (9.4%) in Q3 2025. This represents significant growth over the last two years.

Netflix Share of TV Time in US and UK - Source: Netflix Financial Report Q3 2025

Great comparison is made with competitors like YouTube, which holds a larger estimated share of screen time, around 37.7%(US) and 26.7%(UK), please note that Youtube is not whole "All Other Streaming part" of a chart but we can assume that it is a big part of it. The disparity between these two is understandable, as YouTube's business model - cheap, diversified, and user-generated content - allows it to capture market share rapidly and broadly. However, Netflix operates on a high-investment model, requiring substantial capital and time for premium content. Considering this achieving a TV view share just shy of 10% in competition like that is big achievement for Netflix.

Analyzing Netflix's Regional Revenue Expansion

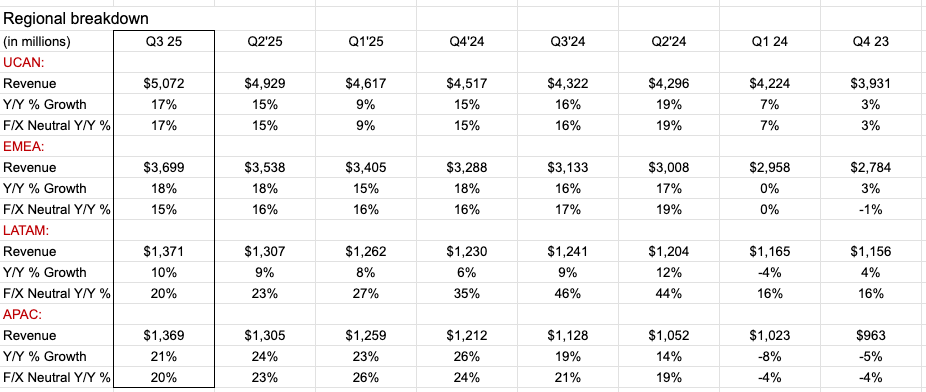

While reviewing the regional breakdown of Netflix's revenue streams, we can observe that the company is setting records across all regions. Most interesting, APAC (Asia-Pacific), the region with the smallest revenue stream, is showing the highest Year-over-Year (Y/Y) growth and is on a strong path to surpass LATAM (Latin America) in revenue contribution. Furthermore, saturated markets like North America (UCAN) and Europe (EMEA) are still seeing surprisingly significant Y/Y growth numbers. This resilience strongly suggests that Netflix's recent strategy of stopping shared accounts is providing highly effective and is returning great results on their financial structure.

What Netflix's Financial and Engagement Data Means for the Future

Now, let's talk about the future of Netflix. As these numbers indicate, Netflix remains one of the primary choices when considering paid subscription options. Revolts that occur every few months, driven by the idea of decreasing subscriber numbers, are, for now, not showing any significant dent in Netflix's revenue streams. I'd even suggest the idea that these events are providing Netflix with a form of free marketing.

Khm. It's not unusual to get caught in an internet bubble where everyone around an individual appears to be quitting a service, leading to the perception that the entire world is following it. However, at the end, it seems these so-called "rebels" often find themselves back on the subscription list within a few months.

Netflix's P/E ratio is just shy of 40, and with that high valuation, it is not easy to say that this is the ideal buying position. However, with nearly 43% of the linear TV market still available to capture, it is reasonable to believe that Netflix will increase its user base even in the most saturated markets.

As I'm writing this, Netflix's stock fell by more than 6% (after market close), and we will likely see a continued dip in the coming days or weeks. Still, I believe this company will generate positive returns for investors and may return to All-Time High (ATH) values within a few months.