Amazon Delivers Strong Quarter While Investing Aggressively in AI Infrastructure - Q4 2025 Earnings Review

Amazon is accelerating in cloud and advertising while committing unprecedented capital to AI infrastructure. The market is nervous. However, I look at it differently. Here is why I believe this investment cycle could define the next decade.

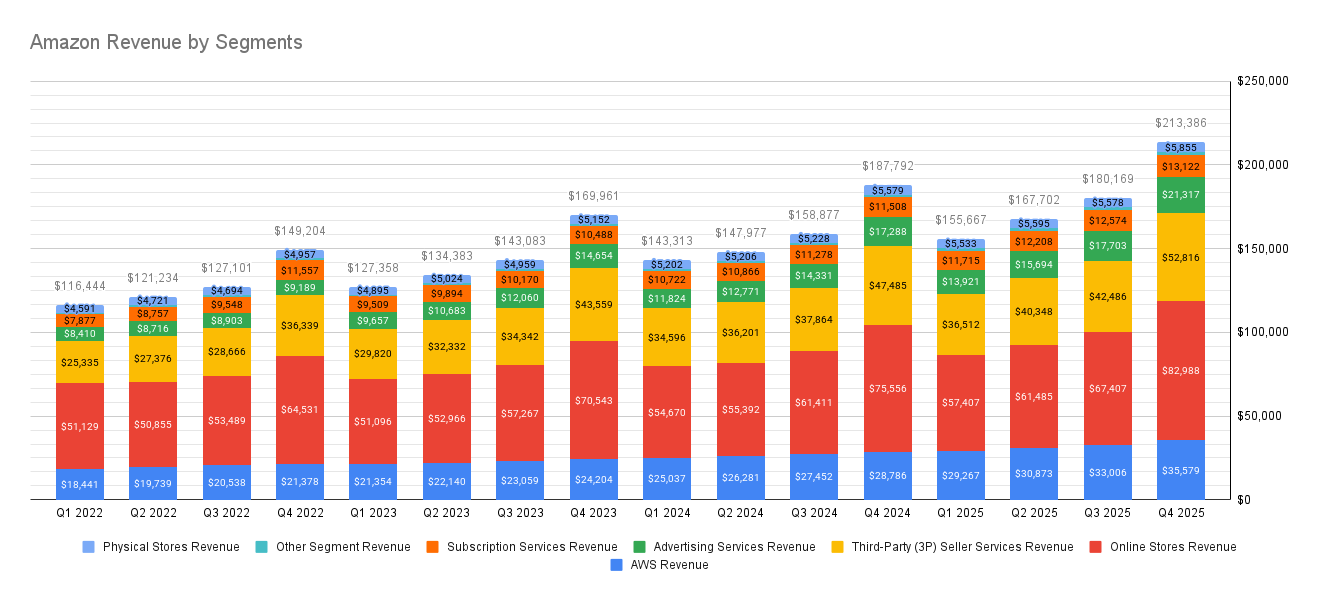

Amazon reported fourth quarter results that beat guidance. Net sales increased 14% YoY to approximately $213 billion. Operating income rose to $25 billion compared to $21.1 billion in the same quarter last year.

Revenue reached record levels across all segments. What stands out most is acceleration in the two most important profit drivers. AWS grew 24%, its fastest growth in 13 quarters, and Advertising increased 22% (more on this later).

Many Investors questioned whether Amazon was losing ground in cloud (and it was right question to ask). With growth reaccelerating at this scale, that concern doesn't hold a stand. For a business with high market share, 24% growth is not ordinary. It signals demand strength and improving momentum.

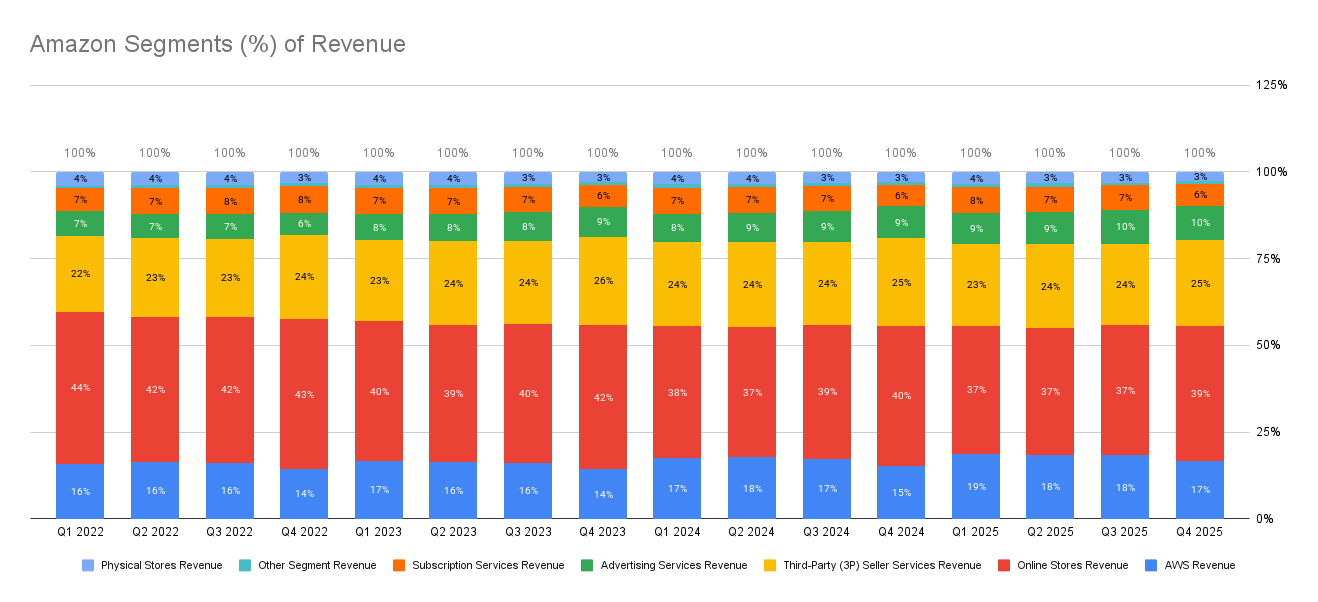

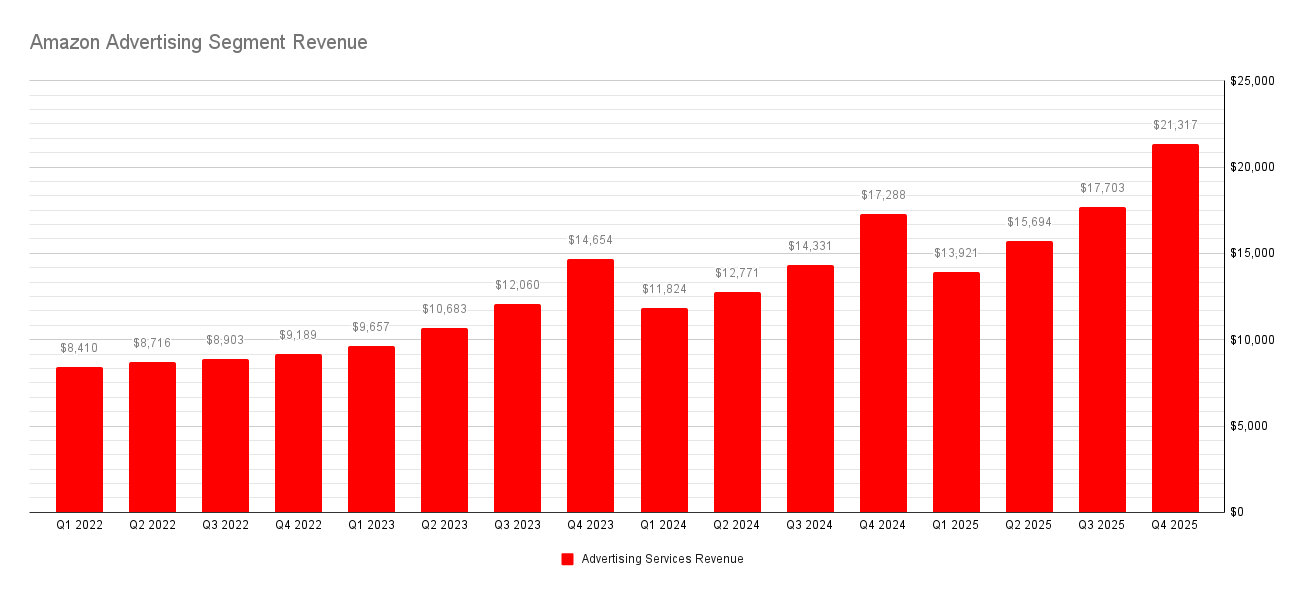

Amazon Revenue by Segments Absolute and Relative Value

Advertising continues to be the segment that excites me most. It is high margin, asset light, and still relatively early in its development compared to the core retail business. This quarter advertising revenue exceeded $21 billion with growth close to 24%. If this growth continues, we could see that Q1 2026 revenue overpass Q3 2025 which would be a nice performance to see in such high-margin segment.

$200 Billion in Capex Focused on AWS

The announcement of 200 billion dollars in capital expenditures for 2026 immediately impacted the stock price. This compares to $131B in 2025 and $83 billion the year before. It is the largest spending program among megacap technology companies.

AWS backlog stands at $244 billion, indicating strong demand visibility. Andy Jassy stated that AWS could grow even faster if capacity were available. That suggests constraints are currently supply driven rather than demand driven. Also, he stated that this is very similar to the CAPEX spending in core AWS business which they have done before.

We have confidence that we, that these investments will yield strong returns on invested capital. We’ve done that with our core AWS business. I think that will very much be true here as well.

- Andy Jassy

I would like to mention that Amazon is also working at vertical integration of AI infrastructure. Their custom silicon strategy is gaining traction. Trainium and Graviton chips are approaching combined annual revenue of around $10 billion with triple digit growth. With time this will result with improving margins and will strengthen competitive positioning over time.

Why Wall Street Is Nervous?

What concerns Wall Street is idea that spending $200 billion is not only a question of demand, but also one of execution. Capital at this scale must be deployed efficiently and at the right time. If infrastructure is built too early, returns will be slower than expected. If hardware cycles evolve faster than anticipated, current investments risk becoming outdated before they generate adequate returns.

Technology changes rapidly, especially in AI, and what appears to be an advantage today can erode within a few years.

Risks Investors Should Consider

The most obvious risk is that AI demand slows and expectations prove too optimistic. However, AI does not need to become a perfect system to justify infrastructure investment. Even if we don't see god-like machine in next few years it is already embedded in logistics, software development, marketing, healthcare, creative and financial services. Even incremental productivity gains can support long term demand for compute power.

Execution risk remains meaningful and we already talked about it. Scaling infrastructure globally requires precise timing, supply chain coordination, and cost control.

Regulatory and geopolitical risks also matter. Amazon operates globally, and increasing political tensions could complicate international expansion.

Stock Price and Long Term Thesis

The stock price has not made progress over the past 12 to 18 months. The recent decline from 240 dollars to around $200 appears driven more by sentiment surrounding an AI bubble narrative than by fundamentals.

Historically, Amazon has increased capital expenditures aggressively when new technology cycles emerge. It did so during the early cloud era and during logistics expansion. In both cases, those investments later translated into structural competitive advantages. Also, it is not only Amazon spending such a big money on AI infrastructure. Alphabet, Meta, Microsoft are having big jump in CAPEX spending.

If the largest technology companies in the world are aggressively allocating capital toward AI infrastructure, it is unlikely they all miscalculated the long-term opportunity.

From my perspective, the stock is undervalued below 200 dollars. Volatility could push it lower, and 175 dollars would not surprise me in a negative sentiment environment. However, if AWS maintains growth above 20 percent and advertising continues expanding margins, operating income can scale meaningfully over the next several years. Under that scenario, valuation around $310 seems justified and I will keep it as it is in my Watchlist.

We are still in the early stage of AI adoption. Many industries have yet to integrate AI meaningfully into daily workflows, and entirely new jobs will be created as the technology matures. With accelerating cloud growth, expanding advertising margins, diversified revenue streams, and significant competitive moat, I believe Amazon is well positioned to navigate the next five to ten years successfully.