Amazon Q3 2025 Deep Dive: Record Quarter, AWS Acceleration and 5-Year Revenue Forecast

Amazon’s latest Q3 results confirm the strength of a company that continues to grow. AWS is regaining momentum, retail remains a massive but steady engine, and advertising is quickly becoming one of Amazon’s most powerful profit drivers.

More than eight months ago, I published my deep dive into Amazon’s Q4 2024 earnings and shared my bullish outlook on the stock. Back then we had plenty to talk about – the escalating tariff situation, the early days of Project Kuiper, the rollout of AI features across the shopping experience, and more. At the time the stock was trading around $175 and I clearly said: anything below $190 is an obvious buy for me.

Fast forward to today and we’re sitting at roughly $230 – that’s more than 30 % upside from my “obvious buy” zone and over 20 % personal profit locked in. With numbers like that, it’s the perfect moment to revisit the thesis, update the key metrics, and see what the fresh Q3 2025 report is really telling us.

Amazon Record Revenue Growth of 13 %

Amazon just delivered its best Q3 ever – revenue beat Q3 2024 by a solid 13%, which is seriously impressive for a company of this scale. On a trailing-twelve-month basis the growth still sits at +11% year-over-year.

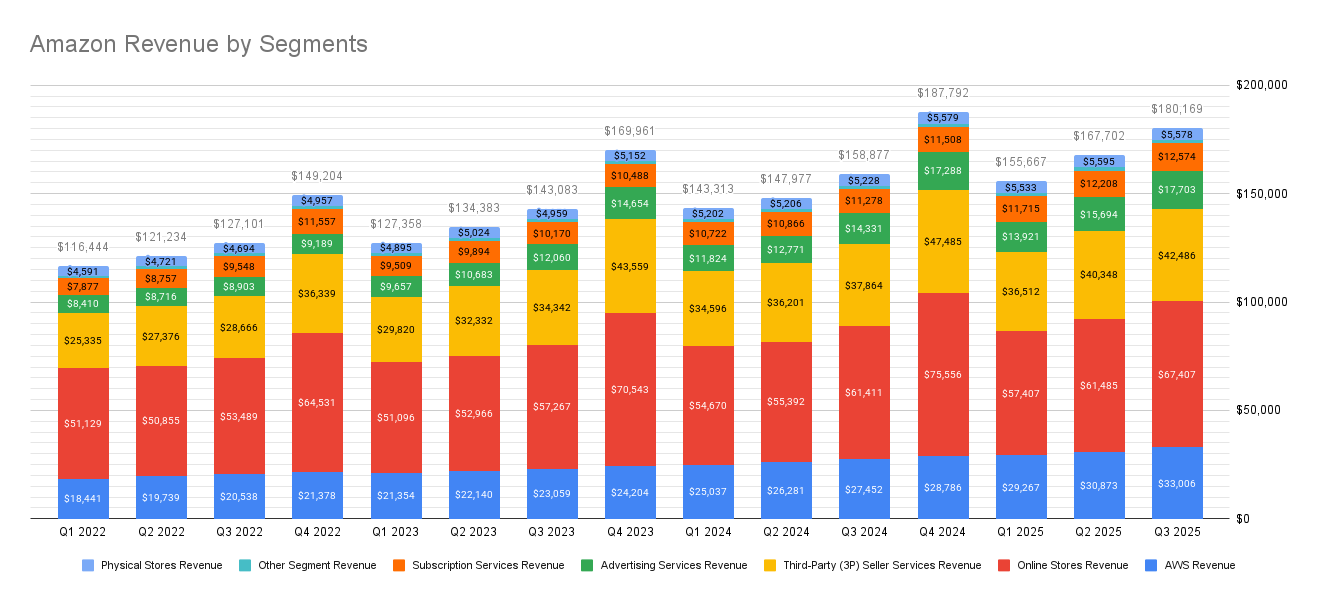

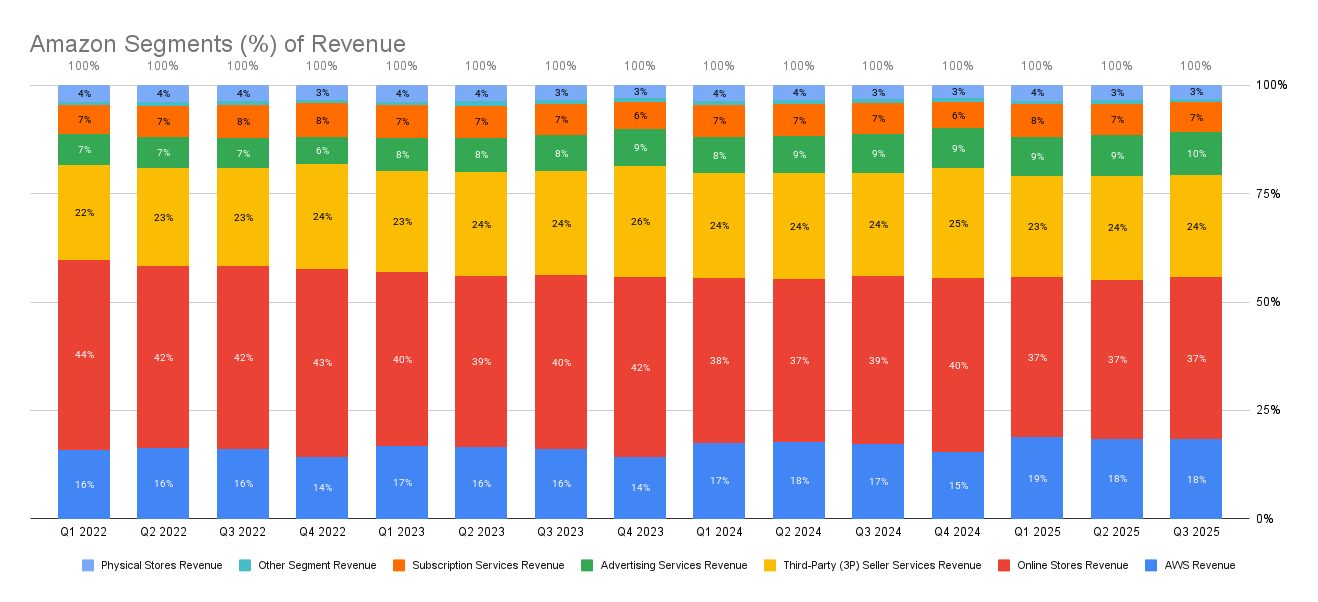

As the charts below clearly show, Amazon continues to dominate three of the fastest-growing markets on the planet: e-commerce, cloud computing, and digital advertising - and it remains the leader in two of them.

Amazon Revenue by Segments

AWS (Cloud Computing) - the most stable and reliably growing part of the entire Amazon machine - is now back to a clean 20% YoY growth rate. For a long time investors were worried that Amazon was losing ground and that competitors were growing faster. Reality check: AWS still owns north of 30% global market share and remains the clear leader.

I actually expect the growth rate to accelerate again, and my base case for next year is 25% YoY. As a main reason I would like to mention Project Rainier and the two gigawatt-scale Anthropic clusters coming fully online in 2026. Once those hit full stride, the revenue (and margin) uplift should be massive.

The slowest-growing segment of Amazon’s empire is still the one everyone thinks of first: retail (online stores, physical stores, and third-party seller services). It remains absolutely massive - roughly $420 billion in calendar 2024, and the last twelve months just crossed $450 billion with this report.

We’re still waiting for the all-important Q4 numbers (historically the strongest quarter for retail), but I expect low-double-digit growth around 10% YoY and I don’t see that changing dramatically anytime soon. North America already treats Amazon as the default shopping platform, Europe is basically fully penetrated with local warehouses, and Amazon is still the fastest and most convenient option almost everywhere it operates. In Asia and Latin America the competition is brutal, so I’m not forecasting any big growth spikes from those regions going forward.

The segment I’m most excited about is Amazon Advertising – the highest-growth and high-margin engine in their portfolio. The ads market is brutally competitive, yet, Amazon is still pushing almost 25 % YoY growth and I expect it to stay in the low-to-mid 20s for the next few years.

Last 12 months the ads business is already contributing $64 billion annualized, and because of its lucrative operating margins and big scale opportunities on the Amazon platform, I’m convinced it will become one of the company’s largest and most profitable revenue streams in next few years.

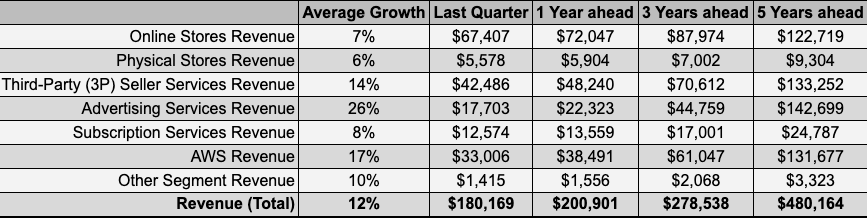

Revenue and Price Forecast for Amazon Business segments in next 5 Years

Even though Amazon is already one of the largest companies on the planet, I actually think its revenue trajectory is pretty straightforward to forecast. In the table below I took the average growth rates of each segment over the past three years and simply extended them forward for 1, 3, and 5 years.

The result? Even with fairly conservative assumptions (and yes, I’m still more bullish on AWS and Advertising than these averages suggest), Amazon should comfortably more than double its total revenue in five years. A lot of growth-oriented investors will say “only 2× is not enough,” but for a business already closing in on $650 billion in yearly sales, I think that’s absolutely remarkable.

On the stock price side, I’ll keep it simple: I see Amazon trading north of $300 within the next 12–18 months – and I’m comfortable putting that call on record. (This is not financial advise)

If you haven’t seen it yet, I recently launched a new “Watchlist” page here on the blog where I track every stock I cover, including entry levels, targets, and quick updates. I refresh it every couple of weeks (sometimes monthly) with a short comment on why I think the price is headed higher or lower. Feel free to bookmark it and hold me accountable!