Apple’s Record-Breaking Quarter, China Surprise, and the Big Question Around AI

Apple is gearing up for its next product launch and a refreshed software design, while its stock trades below all-time highs. Here’s my outlook on Apple’s Q4 performance, key price levels to watch, and how I plan to position my investment strategy.

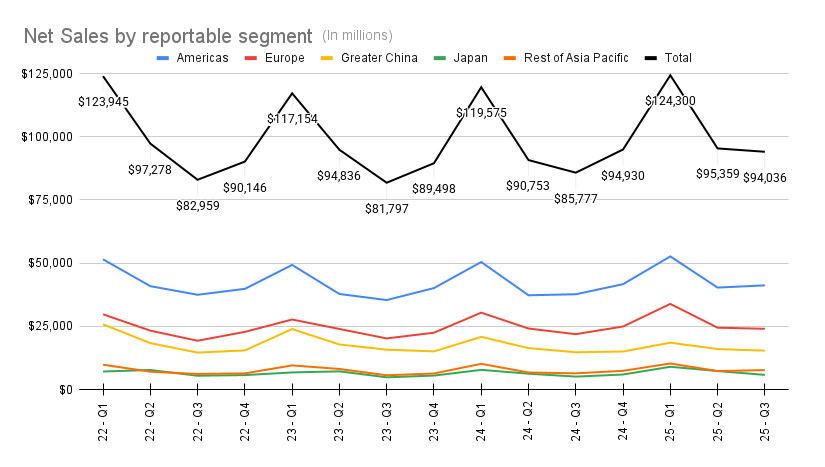

On June 28, Apple released its financial results for the third quarter of 2025. As many of you have already seen in the news, the company reported a 10% year-over-year revenue increase, reaching $94.0 billion. Along with this record-breaking third quarter came a 12% rise in earnings per share (EPS), now at about $1.57.

With that brief summary of financial report now is time to talk about what is behind this revenue increase.

First thing first, this is the first quarter in a long time where Apple has managed to grow net sales in very harsh market - China. Considering political efforts in that country I am surprised how good Apple is standing there. This quarter, sales in China came in at $15.36 billion, a gain of roughly 4.5%.

On its own that number is not so huge especially when compared to some other regions like Japan(around 13%) and Rest of Asia Pacific(close to 20%). It shows that customers are gradually coming back to the brand and that they are not fully satisfied with what competitors are offering in that market.

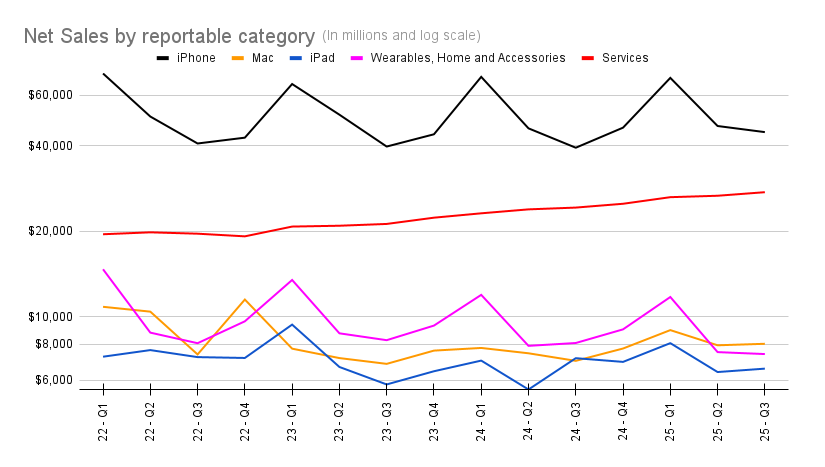

When looking net sales per category we can see steady increase in iPhone, Mac and Service category. What's interesting here is how often investors have been saying that that Apple doesn't have "magic" and that they lost their creativity. Many of them even proposed that iPhone and Mac sales wouldn't grow anymore, and that Services would be the only category with real upside in future.

As a long term investor in this company I a`m very pleased to say that these assumptions were a bit too narrow, and that many of these investors just wanted to make "doom day title" for their readers.

Apple’s AI Strategy: Why Siri Still Lags Behind

Artificial intelligence, the topic which needs to be addressed when talking about Apple. It’s no secret that Siri is far behind what competitors are offering, and most of the AI features inside the iPhone still feel more like toys than truly useful tools.

There might be a reason for this. It seems Apple still hasn't figured out how to integrate AI in a way that feels natural with their ecosystem. For now, what we see loks more like a playground of experiments - features that serve more as a statement of "we are doing something" rather than real value additions. My view is that Apple is still testing what best approach might be. If I need to say it, eventual solution to "Apple AI problem" may not even come from their own R&D powerhouse but through acquiring company which is already strong and established player in AI space.

Recently, the biggest rumors have been about Apple acquiring Perplexity. To be fair, it looks like this was more of an internal discussion than a serious deal on the table. And; Perplexity isn’t exactly “cheap” right now, with its last valuation at around $14 billion — not the kind of acquisition Apple would make on impulse.

Apple Stock Forecast: What to Expect Ahead of the New Product Launch

Looking ahead, Apple is set to release its new product lineup in about 30 days, along with a refreshed software design that should make their devices instantly recognizable. Early users of the new version have noted some minor readability issues, but I’m confident Apple will resolve those sooner rather than later.

Right now, the stock is trading at $231, still below its all-time high of $260. If the current momentum continues, I expect Apple to deliver a record-breaking fourth quarter, with the stock likely surpassing its ATH shortly after earnings are announced.

What you will read in next paragraph are just my personal thoughts, not a crystal ball. Don’t buy or sell Apple stock just because I said something — think it through, do your own research, and make your own call.

From an investing standpoint, if the price pulls back to around $214, I see that as a safe entry point to add more shares (already made some short PUTs around this value). On the other hand, if hype pushes the stock over $290 by the end of the year, I’d consider taking profits and waiting for a more reasonable re-entry opportunity.