ARM Is Quietly Becoming the Backbone of AI Infrastructure

ARM is no longer just a chip designer for phones and PCs. It is quietly becoming the backbone of the AI revolution, powering everything from autonomous vehicles to robotics. I take a deep dive into their growth, strategy, and why investors are watching closely.

Price volatility of ARM has been on another level. The last time I covered this company, the stock was hovering around $170. Within four months it dropped nearly $100 and then rebounded to $128, which sits close to the middle of that range. For a moment it even looked like the stock could fall toward $50. Gladly, that did not happen. Today, with price stabilizing, I feel comfortable sharing my updated thoughts.

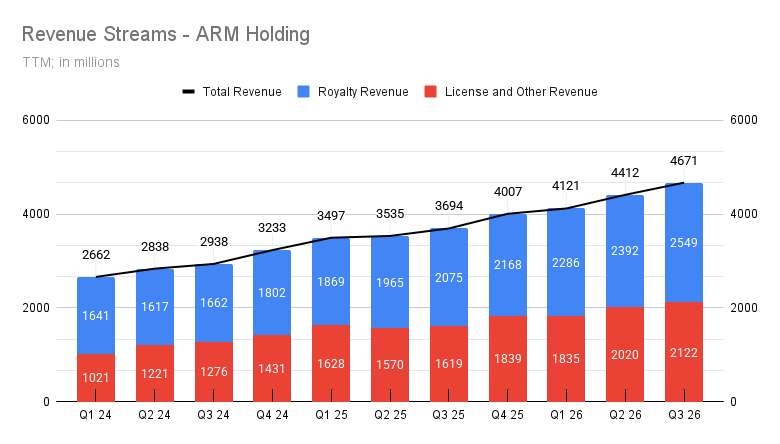

On the fundamentals side, the company continues to deliver growth. Total revenue increased 26% YoY to approximately $1.2B, marking the fourth consecutive quarter above the $1B level. Royalty revenue grew 27% to $737M, showing strong demand across end markets. Net income declined 12% to $223M from $252M, but EPS still came in at $0.43, beating estimates by about 5%.

A key part of ARM’s business model is signing licensing agreements with major customers such as Qualcomm, Apple, and Nvidia for new chip designs. Licensing today lays the foundation for royalty growth tomorrow. Encouragingly, ARM continues to expand this base. Licensing revenue reached roughly $505M for the quarter, up 25% compared to Q3 2025. That momentum suggests the future royalty pipeline remains strong.

ARM = The Foundation of Physical AI

ARM is clearly pushing to become a core player in AI infrastructure. In its latest quarterly report, the company dedicated nearly three pages to its AI strategy. That alone signals how central this market has become to its long-term vision.

What makes this opportunity different is the "shift" from cloud-based AI to physical AI. Systems operating inside vehicles, robots, and autonomous machines. These environments require efficient processors that continuously monitor sensors, prioritize tasks, and respond in real time while consuming minimal power. This is exactly where ARM’s architecture excels.

And this is not just theory. Real deployments are already happening and you can read them from company report:

Leading innovators recognize this and are building custom Arm-based chips to tightly integrate AI, sensing, and realtime control while preserving software continuity. In December, Rivian announced its third-generation Autonomy Computer built on the Arm-based Rivian Autonomy Processor, powering their first production vehicle based on a custom Arm chip and the first to deploy Armv9 in a production car. Tesla’s upcoming Optimus humanoid robot is also powered by a custom Arm-based AI processor, underscoring Arm’s role at the forefront of physical AI.

At the same time, the broader robotics and autonomous systems market is scaling through Arm-based platforms from leading silicon providers. NVIDIA’s Jetson Thor platform and Qualcomm’s Dragonwing platform are built on Arm and are widely used to power robots, autonomous machines, and intelligent vehicles across industries. Together, these deployments reinforce Arm as the common compute foundation for the physical AI ecosystem.

To me, this shows that ARM is positioning itself at the core of AI infrastructure. The company already dominates smartphones and has expanded into PCs, especially in areas where energy efficiency is most important, such as Apple’s Macs and Google’s Chromebooks.

Gross profit and Research and Development

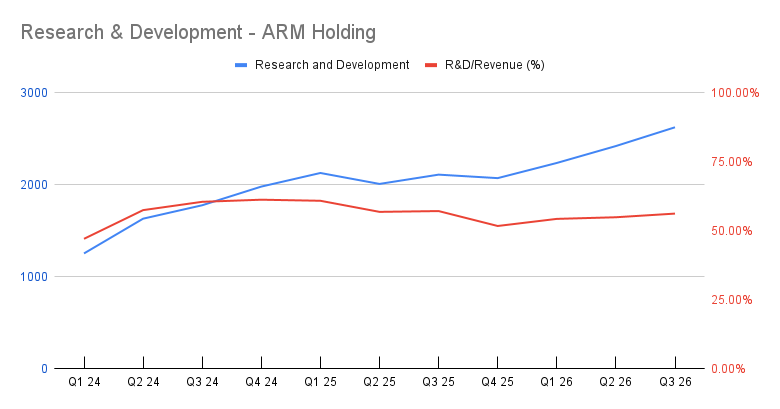

R&D is the core of ARM’s business model. In many ways, the company’s strength is directly proportional to how much it invests in innovation. The more ARM spends on developing new architectures and improving performance efficiency, the stronger its long term competitive position becomes.

It is encouraging to see that spending increased in the last quarter. Higher investment today means more advanced designs tomorrow, which supports future licensing growth and eventually stronger royalty streams. The R&D to revenue ratio remains elevated at around 55%, showing that the company continues to prioritize innovation over short term margin expansion.

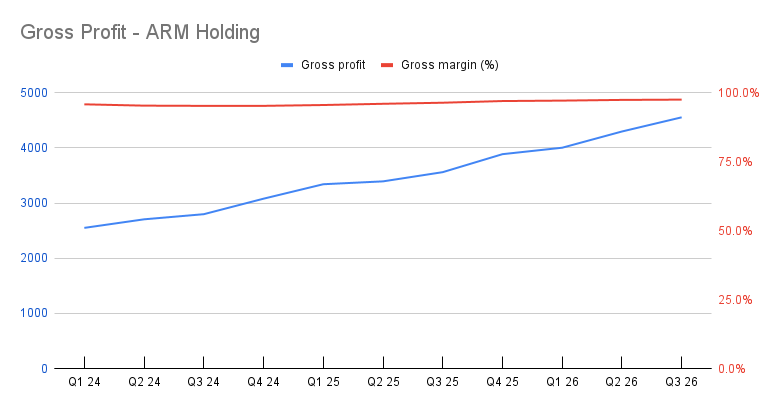

Gross Profit and Research and Development - ARM holding Q3 2026

At the same time, gross margin reached a record 97.5%, which is above historical averages. This highlights the scalability of ARM’s model and the strength of its high margin licensing and royalty structure.

Risk behind AI narrative: AI Hype vs. AI Adoption

Now it is time to talk about risks. Let’s be honest, AI excitement is real, and it is clear that AI has already moved beyond its chatbot phase. Everyone in investing is talking about physical AI, robotics, and autonomous systems.

But adoption does not always move in a straight line. It is entirely possible that these industries will need more time before large-scale implementation becomes reality. If that happens, demand for ARM-based AI chips could grow slower than expected. And while it seems unlikely, it is still possible that some of the biggest players may decide to develop their own platforms instead of relying on ARM.

P/E Ratio, Valuation and My Position

ARM is expanding into markets that were barely part of the conversation at the time of its IPO. Today the company is positioning itself not only in smartphones and PCs, but also across AI infrastructure, robotics, and autonomous systems.

The valuation, however, remains high. The trailing P/E is around 171, while forward P/E is just above 60. That alone tells you expectations are high. This is not a bargain entry point.

At the same time, major selling pressure appears to be behind the company. Nvidia has exited its position, removing an headwind on the stock, and most importantly SoftBank has clearly stated it does not plan to sell shares. That brings more stability to the shareholder structure.

With the stock trading around $128, I remain invested. I expect revenue growth to stay above 20% annually. If execution continues at this pace, I believe the long-term reward outweighs the risks.