Inside ARM: How the World’s Chip Architect Keeps Its Edge (and Why Investors Should Care)

Arm powers the chips behind billions of devices, yet most investors don’t fully grasp its business. With a strong moat, high margins, and a push into AI, cloud, and automotive, it’s a licensing powerhouse - but its high P/E and reliance on clients like Apple make it worth a closer look.

Arm Holdings is a British semiconductor and software design company that (unlike many other semiconductor companies) creates the architectures and blueprints for most of the world's mobile and embedded processors. Instead of manufacturing chips, ARM licenses its Intellectual Property (IP) to companies like Apple, Qualcomm, Samsung, Nvidia, which integrate them into their own products.

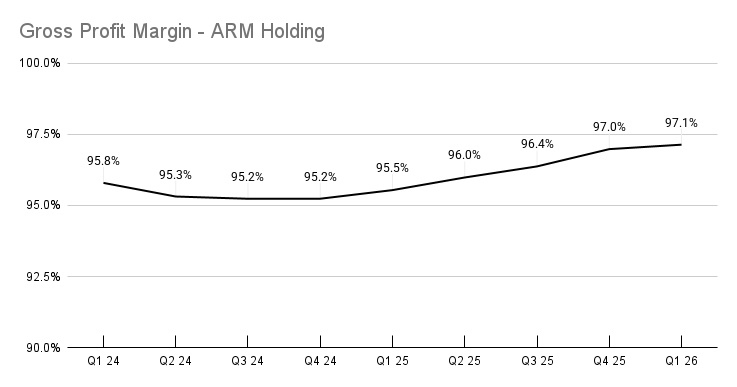

Their low-power and high-efficiency designs dominate smartphones, tablets and IoT, devices, and are rapidly expanding into data centers, automotive systems and AI accelerators. Because ARM earns royalties from every chip built using its technology, it benefits from the global growth of computing without the capital intensity of chip fabrication. This is reason why ratios for this company cannot be compared with companies from chip making industry, simply said, ARM is selling licenses and collecting royalties on their design so their growth margin will always be bigger when compared to other industries. (this is very significant in later stages of this post)

How ARM is making money?

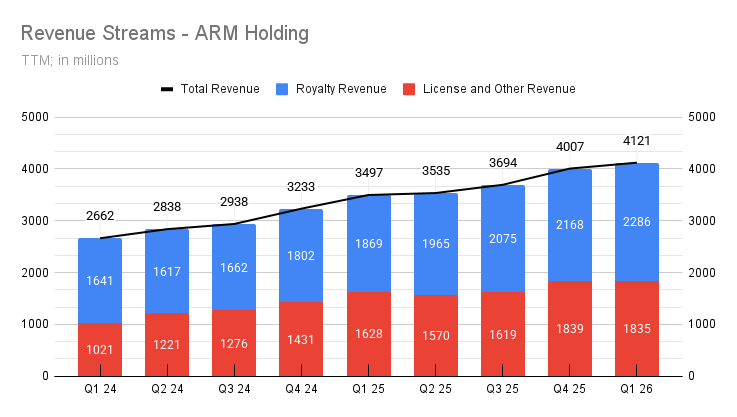

There are two interconnected revenue streams: licensing and royalties.

The licensing segment of business brings in upfront payments from companies that want to use ARM's IP. For example, a chipmaker like Qualcomm or MediaTek pays ARM for the right to use its Cortex or Neoverse cores, or to design their own chips based on the ARM instruction set (Best example is Apple with their M chips).

Royalty business is where real long-term compounding happens. Once a costumer starts mass-production chips that use ARM's designs, ARM earns a small royalty for every chip shipped. This royalty is never bigger than 1-2% and usually is in range of few cents, but, ARM based chips are sold across smartphones, IoT devices, and increasingly data centers and vehicles. This is high-margin, recurring revenue that scales together with global semiconductor production.

As seen from graph before Licensing part of business tends to be shaky part of business. Reason behind it is that each license is one-time event and ARM never can be 100% sure when next large upfront fee will be paid by some chipmaker. Also semiconductor industry is highly cyclical, when new process node (like 3nm) or new product cycle begins industry invest heavily in new chip desings. But, this part of business is very important because licensing builds the pipeline, while royalties monetize that pipeline for years and decades (some of designs made in 1990's still make revenue for ARM).

When looking QoQ we can see increase on both Total Revenue (12.1%) and Royalty Revenue(25.3%). In the same time, revenue from licensing made around -1%. Company CEO Rene Haas is estimating that ARM will continue revenue growth somewhere between 20%-30% which is somehow positive outlook when we take in consideration that in last TTM total revenue increased around 17%.

In previous chart it is presented ARM's extraordinary gross margin which is product of their business model. To say it simple as possible the cost to "produce" one more ARM license or to collect one more royalty is close to zero, while the revenue can be in the millions.

However, the trade is that ARM's operating expanses are very high, especially R&D and personnel costs (their product is human intelligence).

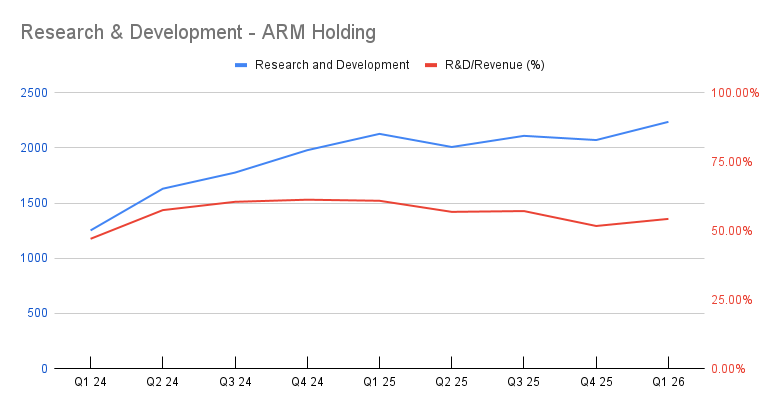

For ARM Research and Development is not optional

Practically more than 50% of revenue goes toward development of new CPU architectures, designing new CPU & GPU cores. It is easy to say that for ARM R&D is not optional it is their business. It fuels future royalty streams by ensuring they are always ahead of competition.

Cutting R&D spending at Arm would be a direct path to stagnation. Within a few years, competitors would start catching up, leading to fewer licensing deals - and naturally, shrinking royalty streams that follow. It’s the same pattern we saw with Nokia: once the leader in mobile phones, slowed its innovation, and eventually became a shell of its former self, surviving today mostly on patent and licensing revenue.

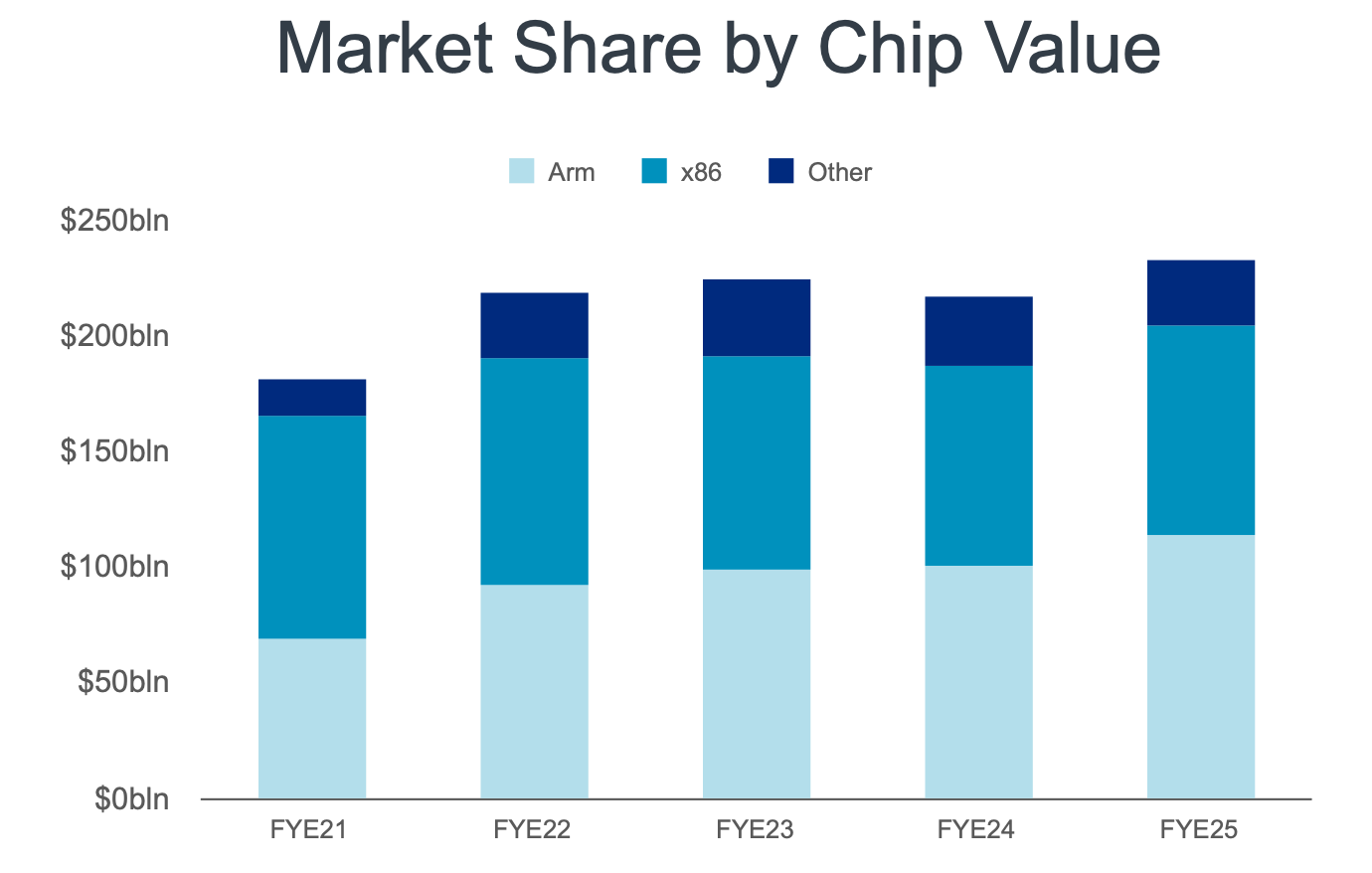

Competition and RISC-V

As of writing this text Arm is holding big advantage with its technology. They work together with Apple, Samsung, Microsoft, Nvidia and others on broad range of products. In last few years most important cooperation is on AI technology where ARM is one of the biggest players. With that in mind according to the last quarter transcript ARM is expecting to shift their market share of ARM neoverse-based chips to top hyperscalers to nearly 50% in this year.

ARM's main competitor is RISC-V, an open source instruction set architecture developed by global community of contributors who improve and use the sam ISA (Instruction Set Architecture) model. Major players such as Google, Nvidia, Qualcomm, Samsung, Intel, SiFive, Alibaba, and Western Digital are actively involved - many of them still rely on Arm but are experimenting with RISC-V in parallel. Strategically speaking, RISC-V remains a long way from posing a serious threat. Arm continues to dominate the mobile CPU market with over 99% share, and it’s hard to imagine that position changing significantly over the next 5-10 years.

Final thoughts

Arm’s future is closely tied to Apple, one of its largest clients. With Apple’s global dominance in both computers and mobile devices, Arm benefits from a stable and expanding base for its licensing and royalty business, making it a potential safe haven within the semiconductor ecosystem.

Strong competitive moat is likely to produce significant growth in the coming years. However, it’s important to keep an eye on the next few earnings reports - the company’sP/E ratio, typically between 80 and 100, reflects a very high valuation. While many investors view Arm as more than just another chip company, such a premium still demands careful monitoring.

At the same time, Arm is actively expanding into higher-value markets such as AI, cloud computing, and automotive. These projects are still early-stage bets, but it’s very good to see the company investing in long-term growth and diversifying beyond its traditional mobile stronghold.