Investing in a World Driven by Headlines - When Narratives Move Faster Than Fundamentals

Markets feel confused right now. Economic data is solid, inflation is cooling, yet fear is rising. At the same time, AI is seen as both the future and a bubble waiting to burst. Let's step back from the noise and focus on what truly matters for investors.

Everyone who is actively investing has had mixed emotions over the last week or two. Because of that, I decided to wait for the final economic indicator before making any conclusions and before deciding how to position myself for the week ahead.

This will be a longer article than usual, but for a good reason. I will connect geopolitics, macroeconomics, the AI bubble debate, and my investing philosophy into one bigger picture. There is a lot happening right now, and I think this broader view makes it even more interesting. Let’s dive in.

US economic indicators were mixed, but the start of 2026 looks promising.

The US economy added around 130,000 jobs last month, almost double what Wall Street expected. At the same time, the unemployment rate ticked down by 0.1 percentage points to 4.3%. That was a small surprise, especially considering that the Trump administration has been working to reduce the number of people employed in government institutions.

On the surface, this was positive news. But for investors, it created confusion. If the job market is strong and inflation is not fully under control, why would the Fed cut interest rates at all? That simple question pushed QQQ down about 1% on the same day.

Then we got another surprise. CPI for January 2026 came in at 0.2% month over month versus 0.3% expected, and 2.4% year over year versus 2.5% expected. Inflation is slowly moving toward the 2% target.

Now the confusion is even bigger. If the labor market is solid and inflation is approaching target, obvious question appear: What will the Fed do next?

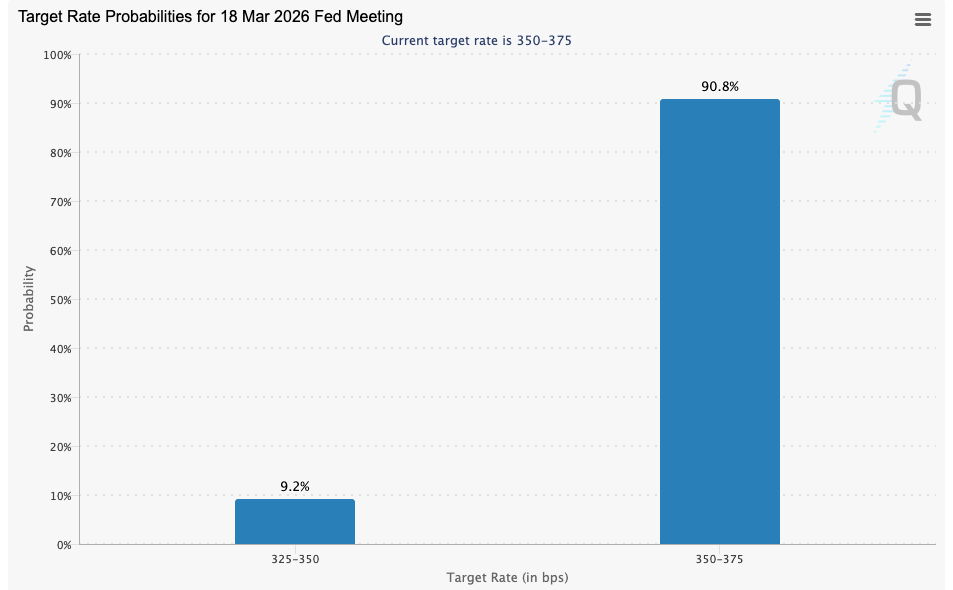

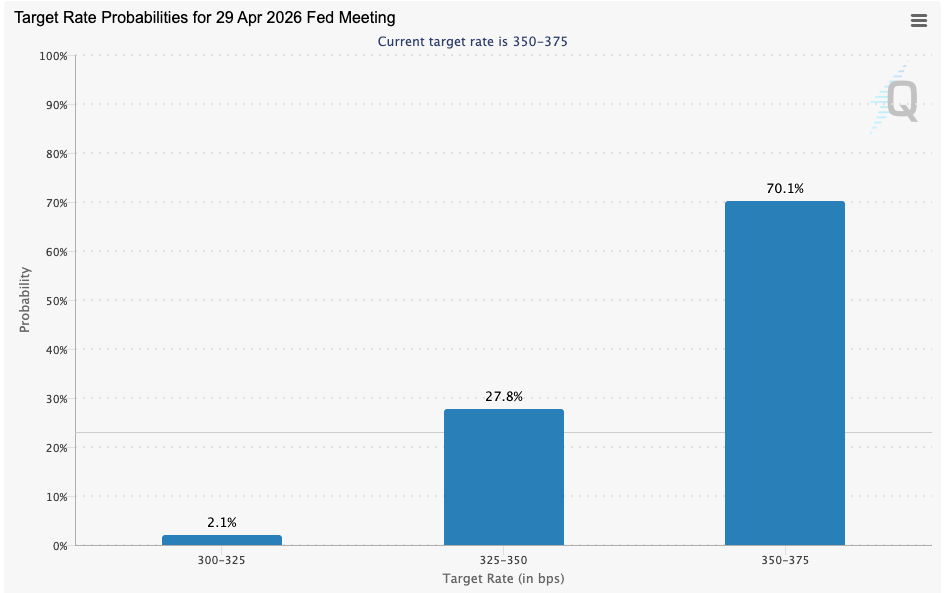

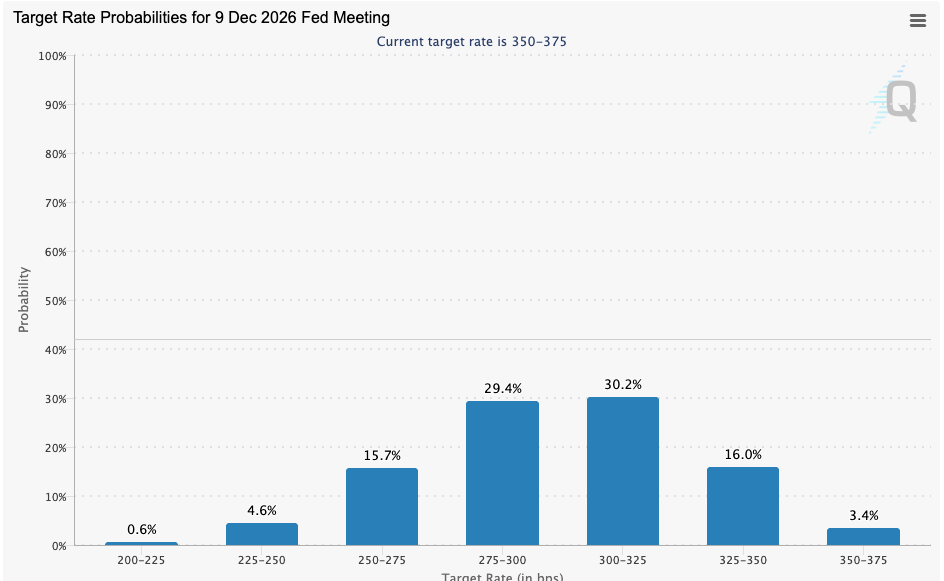

Current market probabilities suggest the first cut could come at the beginning of the second half of the year, and even then the highest probability is only a 0.25% move. By the end of the year, rates are expected to be around 2.75% to 3.0%, which implies two or three cuts from current levels. There are still seven decision meetings left this year, so there is plenty of room for expectations to change.

FED Target Interest Rate Probabilities as on February 2026

In my view, rates in the US should be lower. With this latest data, it seems obvious that the Fed could have moved faster earlier. But it is always easier to analyze decisions like this after the battle is already over.

Global politics looks more like a reality show right now

At the same time as economic data was coming out, geopolitics was changing very quickly. More than ever, it feels less like a serious, thoughtfully driven process and more like a season of a TV show where the storyline changes every week.

As we discussed in a previous article, Trump decided to postpone his Greenland ambitions. Just a few weeks ago it felt like a major geopolitical issue, and now it has almost disappeared from the headlines.

At the same time, the focus shifted to Iran and its more than 20 year internal struggle for a better future. From the perspective of people living in the EU or the US, this feels distant. Let's be honest, It does not immediately affect everyday life in Western countries, so markets (and people) react less emotionally to it.

When it comes to Europe, we see a different dynamic. After what some politicians describe as a victory in the Greenland situation, many political entities in the EU are trying to ride a wave of confidence. There are growing discussions about building independent infrastructure, supporting local businesses, and relying less on American technology companies.

In theory, this sounds strong and ambitious. In practice, I think it is mostly wishful thinking. Building real alternatives to companies like Alphabet, Meta, Amazon, or Apple requires decades of experience, deep technical knowledge, and enormous amounts of capital. At this moment, I do not see Europe having enough of those "ingredients" to create meaningful disruption on that scale.

Stock market and the idea of an AI bubble popping

Now we come to the most interesting part of this article. The stock market and the fear that the AI bubble is about to burst.

If we look at the numbers, SPY and QQQ are actually holding up relatively well. SPY is down around 2.25% from its all time high. QQQ is down about 5.37% and is trading at levels we last saw at the end of September 2025. These are not dramatic crashes.

So why is there so much fear?

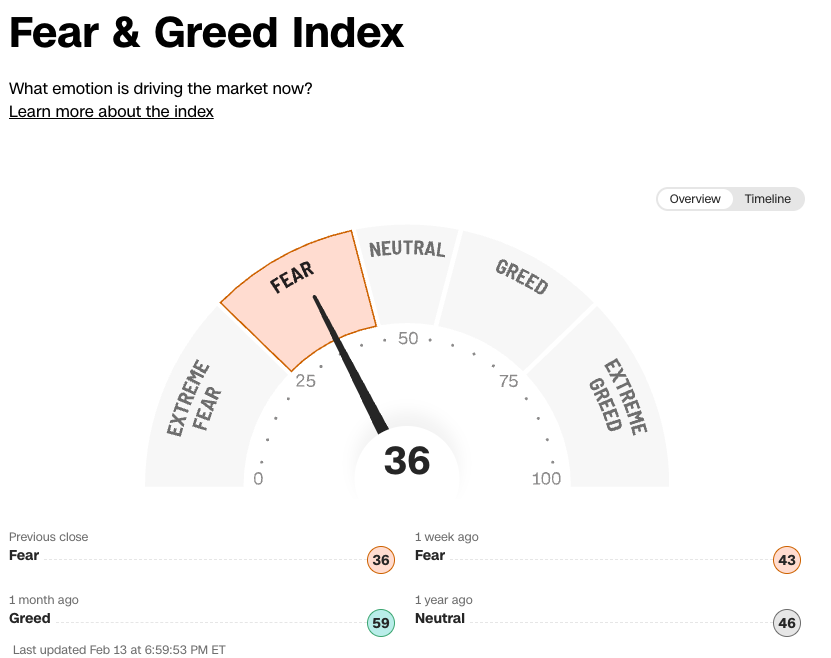

The Fear and Greed Index is sitting in the middle of the Fear zone. Just a month ago it was in greed area. The shift in sentiment has been fast, much faster than the actual price movement.

The first trigger for the tech selloff was the announced CAPEX spending from the big hyperscalers, Microsoft, Amazon and Meta. Around 200 billion dollars in planned spending was enough to start a serious wave of selling on Wall Street. From their all time highs, Microsoft is down about 28%, Amazon around 23%, and Meta roughly 20%. All of them moved below their 200 week average very quickly.

Software companies were hit even harder. The fear that AI can build software in minutes became strong enough to shake even the largest players. Generative AI added fuel to an already burning narrative that the future belongs only to "machine" generated content and not to human creativity and skills.

Here is the part that does not make sense to me. These two narratives cannot exist together for long.

On one side, we are told that we need massive infrastructure to power the next generation of AI products. On the other side, investors are aggressively selling the companies that are building that infrastructure. If AI demand is real and growing, hyperscalers should benefit from investing heavily in capacity.

It feels like investors are afraid of two opposite outcomes at the same time. They fear that AI will be so powerful that people will lose their jobs and software companies will collapse. At the same time, they fear that AI will fail and that all this CAPEX spending will not generate returns.

Usually, these extreme narratives do not last long. After a few weeks or months, reality becomes clearer and the market moves on.

We have seen similar stories recently. DeepSeek was supposed to destroy OpenAI and Nvidia with a superior model that did not require heavy infrastructure. ChatGPT and other large language models were supposed to destroy Google search overnight. Mobile games were supposed to make console and PC gaming obsolete.

Technological disruption has happened many times in history. Tools become better and cheaper. Today we can remake movie classics that were filmed 60 or 70 years ago using just a smartphone camera and modern software, often with better quality and at a fraction of the cost. That does not mean the entire industry disappears. It evolves.

AI Bubble or Opportunity? Why I Am Buying Quality Stocks Now

When I look at everything together, from geopolitics to the stock market, it feels like we are living in a world where ideas matter more than execution. Narratives change quickly. One week something is a massive breakthrough, the next week it is a massive failure. When ideas become too big and too contradictory, they usually do not survive for long. In the end, execution and consistent effort always matter more.

It does not matter if I can build an app that looks like Uber in 10 days. The real challenge is getting users and drivers to actually use it. An app has no value just because it exists. It has value only if people use it every day.

It is the same with AI generated content. You can create 20 books in one evening using an LLM. But if nobody spends their evening reading those books, what is the real value?

That is why I continue to invest in companies with experience, real infrastructure, and proven execution. Companies that are actually building something, not just talking about it. For me, moments like this are opportunities to buy strong businesses at better prices. I already started doing that.

Now the only thing left is patience. In my view, markets do not need years to recognize solid execution. Sometimes clarity comes faster than people expect.