Is Netflix "Dead Money" because of WBD acquisition? - Q4 2025 Earnings Review

Netflix is playing the long game. Q4 revenue beats, subscriber growth, and Warner Bros acquisition show the company is focused on building the ultimate streaming library.

As a long-term investor, I usually don’t check on individual stocks too often. However, with the amount of news circulating around Netflix recently, it feels reasonable to take another look.

In early December 2025, Netflix announced plans to acquire Warner Bros for a total enterprise value of $82.7 billion, or $72.0 billion in equity value. For many readers, this is already old news. Still, the deal has fueled speculation that Netflix could be “dead money” for the next year; potentially even 18 to 24 months.

Q4 Highlights: Netflix Revenue Up 18% and Operating Margin at 24.5%

With that in mind, I want to do a quick recap of where Netflix stands today, focusing on the latest earnings release rather than headlines alone.

All data discussed below should be viewed in context, especially considering that Q4 is statistically the weakest quarter for Netflix.

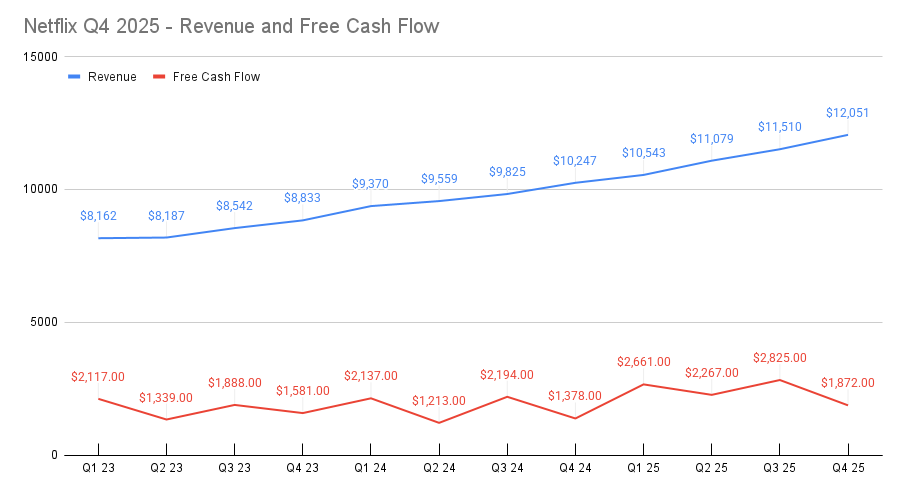

On a full-year basis, Netflix delivered $42.5 billion in revenue, representing 16% year-over-year growth. In Q4 alone, revenue grew 18% and came in just above $12 billion.

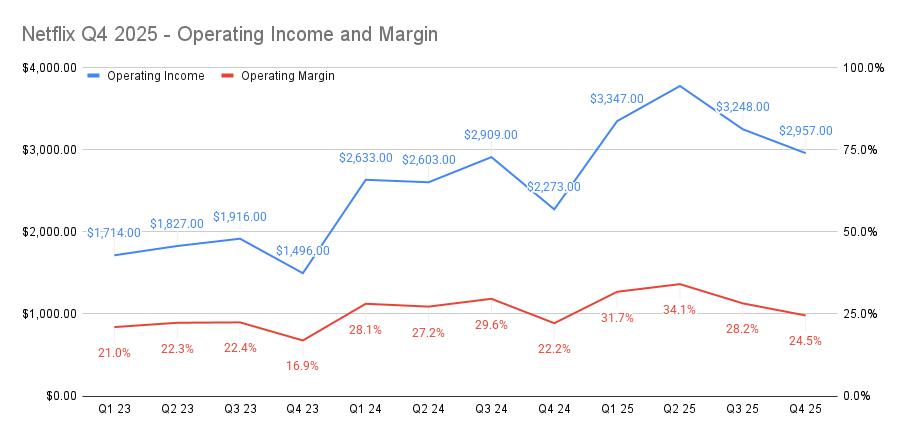

Operating income for the quarter reached $2.9 billion, translating into an operating margin of 24.5%. This was by far Netflix’s strongest Q4 on record, not only in absolute dollars, but also in margin. In fact, operating income in Q4 2025 exceeded every single quarter from the prior year.

Netflix Q4 2025 Revenue, Free Cash Flow and Operating Income

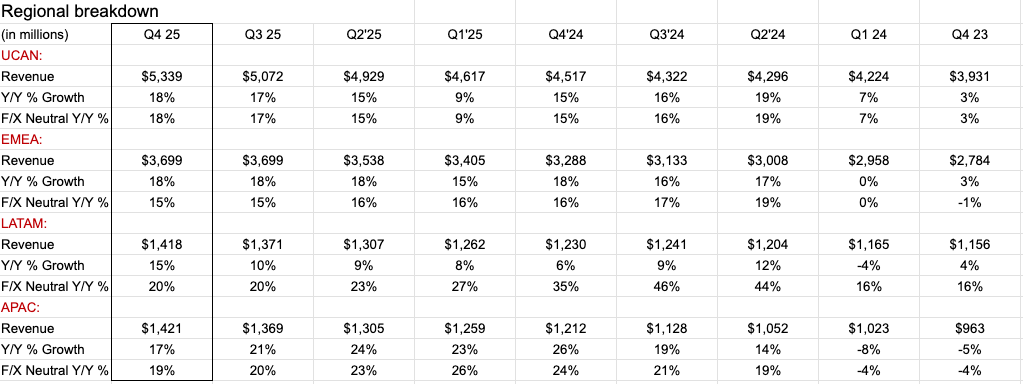

Even more interesting is that Netflix managed to grow revenue in already saturated regions. Both the United States & Canada and Europe posted 18% year-over-year revenue growth compared to Q4 2024.

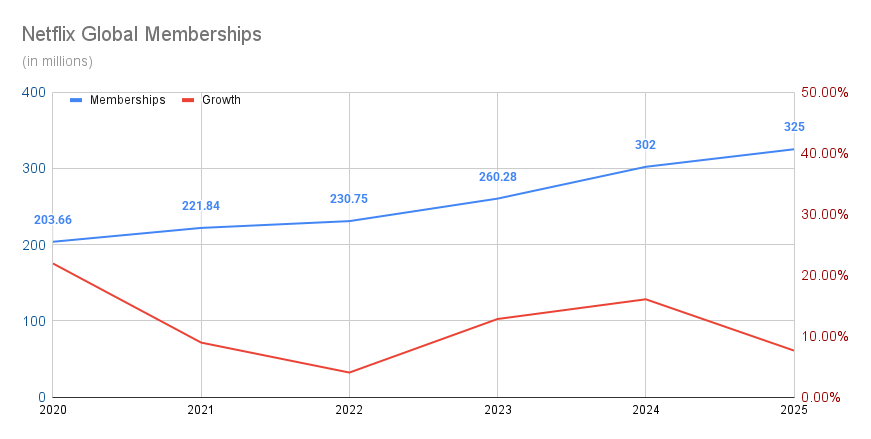

While many predicted that Netflix was far from any meaningful increase in its membership base, the company still delivered 7.62% subscriber growth over the past year. This suggests that there is still room to grow, particularly in less saturated regions such as Latin America and Asia.

Netflix Focuses on What Matters: IP, Scale, and Streaming Growth not Legacy Media

Netflix’s proposed acquisition of Warner Bros is focused strictly on businesses that strengthen its core streaming model (Warner Bros Discovery). The company is targeting content studios, streaming platforms, and large content libraries, while avoiding shrinking legacy businesses such as traditional cable TV networks. Which is approach all investors should look as positive.

The acquisition significantly expands Netflix’s content base and gives the company access to a wide range of valuable IPs that can be developed into new shows, movies, and franchises.

Netflix is not competing only with other streaming platforms, but with the entire entertainment landscape and, ultimately, for a person's total leisure time.

That strategy is already showing results. In the most recent quarter, total viewing hours increased by 2% year over year, driven by a 9% rise in viewing of branded Netflix originals, reinforcing the importance of owning strong IP rather than relying solely on licensed content.

Netflix Stock Price Reaction and Long-Term Outlook

After the earnings release, Netflix shares briefly dropped to around $82 in after-hours trading before moving back toward $84 once the market opened. Even so, I wouldn’t be surprised to see more downside in the coming months. With such a large acquisition on the table, volatility is normal, and a move toward $75 per share is possible.

Some investors see this deal as Netflix admitting it doesn’t have enough content. I don’t see it that way. Netflix has always offered third-party content and will continue to do so even after the acquisition. The goal is simple: build the broadest and most attractive content library possible so members have fewer reasons to leave.

Short term, the stock may struggle. Long term, I still think Netflix wins. If the company keeps executing, in five years its market cap could easily be meaningfully higher than it is today — potentially even double. For me, this is a long-term story, not a quarterly one.

In my Q3 2025 review, I looked at how Netflix was navigating a competitive streaming market. Now, with Q4 results in and the Warner Bros deal on the table, we can see how those strategies are starting to pay off and what it means for long-term growth. Check it out by clicking here.