Owning the Shoreline: My Updated Take on NVIDIA - Q3 2026

NVIDIA is no longer just riding the AI wave - it’s shaping the entire shoreline. A $4T company growing at record pace, returning massive capital, and dominating AI infrastructure. Is this still hype, or the backbone of the next decade?

More than a year has passed since my last post on the world's largest company by market capitalization. Since then, NVIDIA has maintained its position as the world most valuable company, with its market cap now hovering around $4.5 - 4.6 trillion. In that article, I explored investors' key concern: whether customers would ultimately be willing to pay for the AI solutions offered by major tech corporations. At the time, we also noted that Amazon and Apple were actively developing their own chips to meet their growing AI hardware needs. With all that in mind, I believe now is the perfect moment to revisit NVIDIA, examine what's happening with the company today, and share my outlook for the year ahead.

AI Hype or Reality? What NVIDIA's Latest Earnings Reveal About the AI Bubble

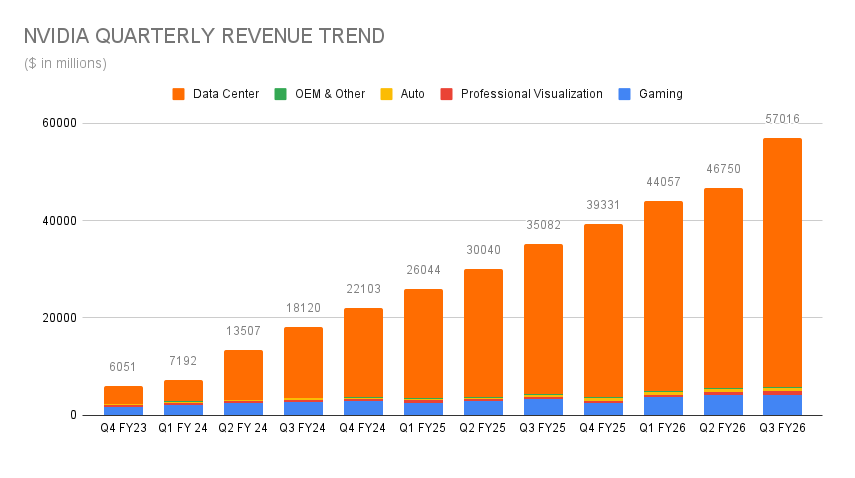

Let's start with the numbers. NVIDIA delivered record revenue of $57.0 billion in its fiscal third quarter of 2026 (ended October 26, 2025), up 22% from Q2 and 62% year-over-year. Meanwhile, the company's profitability remained exceptionally strong and stable: non-GAAP gross margin came in at 73%, operating margin at approximately 63%, and net profit margin around 56%.

The standout performer was the Data Center segment, which posted record revenue of $51.2 billion; 25% increase from the previous quarter and 66% year-over-year. This division now accounts for nearly 90% of NVIDIA's total revenue. While Gaming (up 30% year-over-year) and Automotive (up 32% year-over-year) showed solid growth and even reached record levels, they remain far less material in the overall picture.

For context, very few companies in history have sustained operating margins above 60% at this scale.

Looking ahead, NVIDIA guided for Q4 fiscal 2026 revenue of approximately $65 billion (±2%), which would mark yet another record quarter. It's also worth highlighting the company's aggressive capital returns: over the first nine months of fiscal 2026 (covering the last three quarters), NVIDIA returned $37.0 billion to shareholders through buybacks and dividends - an extraordinary sum given the scale of its operations. This is really huge amount especially when compared to revenue numbers from chart above.

AI Bubble Debate: Misleading Hype or Genuine Concern?

That said, let's address the elephant in the room: Will the AI bubble burst in 2026? First, we must ask whether we're truly in a bubble at all. From my perspective, AI is delivering genuine productivity gains and efficiency improvements across industries. Major companies like Google, Amazon, Meta, and others are actively integrating AI into their core products and services. We're seeing rising adoption among users and businesses, with many already generating meaningful revenue from AI applications. In my view, this is fundamentally different from the dot-com bubble of 25 years ago, where hype far outpaced real utility and sustainable business models.

That doesn't mean the landscape is free of speculation. Many companies will repackage basic logic - essentially a few if-else statements - under the mask of "AI." Others will market their ChatGPT clones as superior alternatives, even when the differences are marginal. This pattern is as old as innovation itself: every emerging industry attracts opportunists seeking quick&easy profits. The AI space is no exception.

With all this in mind, I recommend closely monitoring the upcoming earnings reports from NVIDIA, Amazon, Alphabet (Google), Meta, and other key players. These releases will provide the clearest picture of whether AI demand remains robust and monetization is progressing as expected. (NVIDIA's next report, covering fiscal Q4 2026, is scheduled for February 25, 2026.)

To reiterate, it's crucial to distinguish between a genuinely promising technology - one that will meaningfully improve productivity and daily life - from purely speculative assets like NFTs or many cryptocurrency projects. AI, backed by real enterprise adoption and revenue growth, falls squarely into the former category. While risks and hype exist, the fundamentals appear far more solid than those of past speculative manias.

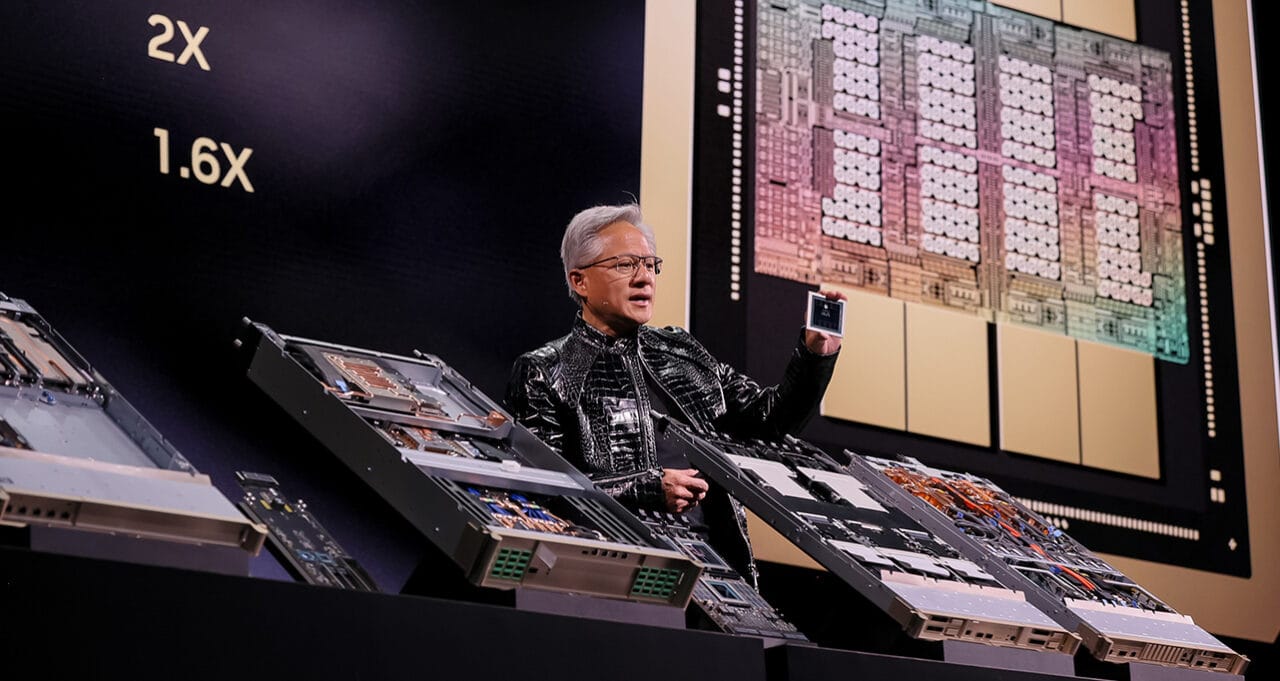

Facing the Competition: Why NVIDIA Isn't Losing Sleep Yet

As predicted, when a company dominates a high-demand product and generates massive profits, competitors try to build their own versions. Most challengers are targeting NVIDIA with niche-focused chips that emphasize energy efficiency, lower costs, and specialized infrastructure. AMD stands out as the strongest rival, having secured a strategic partnership with OpenAI, but other major players - especially hyperscalers like Alphabet (Google) and Amazon are also carving out their own niches with custom silicon.

Despite these formidable names, NVIDIA still commands roughly 90% of the AI accelerator market with its GPUs. Custom chips from competitors currently lag in versatility, particularly when it comes to training frontier models. As a result, many AI players are likely to adopt a dual strategy: developing their own specialized silicon while continuing to depend on NVIDIA for the broadest and most demanding workloads.

Competitors are not trying to replace NVIDIA outright; they are trying to reduce dependence on it - much like airlines hedging fuel costs rather than producing oil themselves.

Unlike other competitors, Apple is approaching the AI chip space on a different level, focusing (as it always does) on vertical integration. The company already powers on-device AI features (such as Apple Intelligence) with its highly efficient M-series and A-series chips. In my view, this on-device approach remains limited in scope and practicality for now, delivering results that are far from the performance needed for frontier-scale models. That said, if Apple succeeds in scaling its efforts over the next few years, it could mark a significant milestone in consumer AI. For now, Apple's strategy prioritizes privacy, efficiency, and seamless user experience in its own ecosystem, rather than directly competing in the data center or enterprise AI accelerator markets where NVIDIA dominates.

Is NVIDIA a buy; hold or even sell now

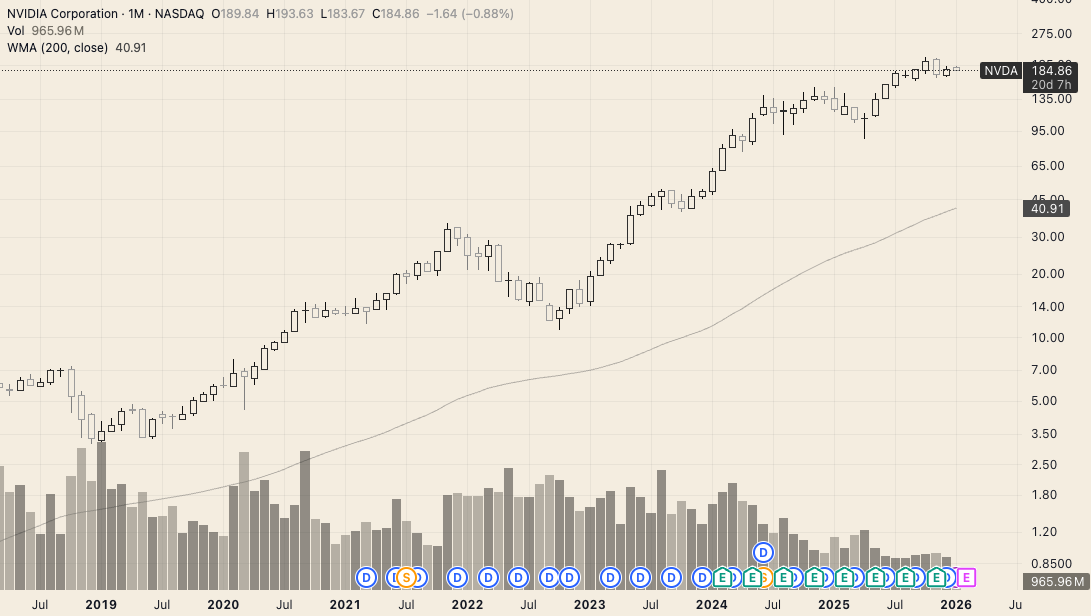

With a forward P/E around 25, NVIDIA is trading at valuation levels we haven’t seen in the past few years. We are talking about a nearly $4 trillion company that is still growing revenue at roughly 20% quarter over quarter while maintaining exceptionally strong margins.

From my perspective, at today’s price of $184, NVIDIA qualifies as a buy. Not a “strong buy”; because the long-term story still needs to prove how quickly competitors can bring viable alternatives to market. Demand for NVIDIA’s hardware remains strong, and for now, the company continues to sit at the center of the AI infrastructure.

In my previous article, the central question wasn’t whether NVIDIA could grow, but whether its customers would make AI profitable. If you want to see how my thinking has evolved, you can read my previous NVIDIA analysis on a link below.

If you prefer a high-level overview instead of deep dives, my watchlist page offers a one-page snapshot of the companies I’m following and how I currently view each of them. You can check it out by clicking on this text.