Pinterest - More resilient than ever - Q2 2025 - Earnings Review

User growth, ARPU shifts, and a few quiet records might signal something bigger on the horizon. Is $1.3 billion in revenue within reach? Let’s dig into the numbers and see what's really going on behind the headlines.

It's been five months since I published my last review of this interesting company. At the end of that article, I shared my view that the stock was a clear "BUY" at $31. If you're curious to revisit that analysis, you can check it out at the link below.

Five months later, the stock is now trading around $39 — a gain of roughly 20%, compared to a 10% increase in the SPY over the same period. With two quarters behind us since that last review, it’s the perfect time to take another look at how the company is performing and what we might expect in the upcoming quarter.

Financial Highlights

Comparing Q2 2024 to Q2 2025, revenue grew by an impressive 17%, reaching approximately $998 million. This is a fantastic result — especially considering that just two quarters ago, we celebrated Pinterest crossing the $1 billion mark for the first time. Now, the company is nearly hitting that milestone again in Q2, which, along with Q1, is typically one of the slowest quarters of the year.

Operating performance remains strong as well: net cash from operating activities came in at $208 million, and free cash flow reached $197 million — both of which are record highs for a Q2.

Pinterest also continues its commitment to innovation, with R&D spending holding steady at 21% of revenue, consistent with previous quarters.

Monthly Average Users (MAUs) and Average Revenue per User (ARPU)

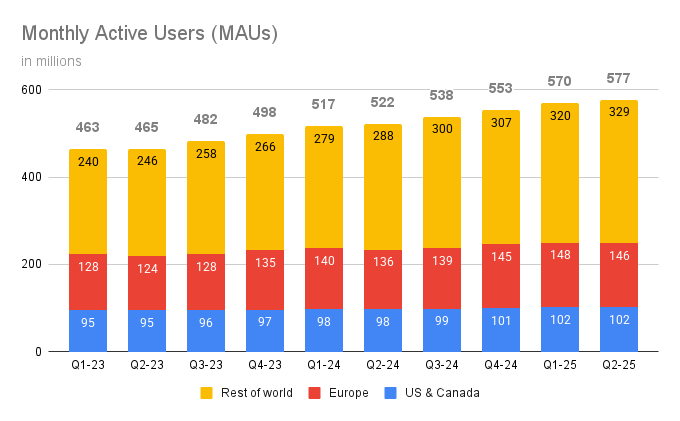

Now lets talk about more interesting results. Global Monthly Active Users (MAUs) grew by around 11% year-over-year, with the strongest growth coming from the "Rest of the World" region. As expected, that segment saw a 14% increase, rising from 288 million to 329 million users.

In the U.S. and Canada, MAUs held steady compared to the previous quarter, but when compared to Q2 2024, there’s still a solid 5% increase. Europe saw a slight dip when compared to last quarter, from 148 million to 146 million, but year-over-year, that still represents a 7% gain.

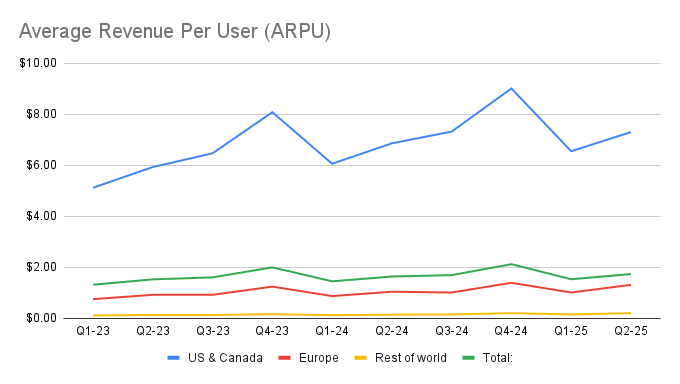

Biggest surprise for me happen under average Revenue per User where increase in "Rest of World" region increased by 44% and is now standing stady at $0.19. While that may not seem like a huge number at first sight, when combined with strong user growth, it resulted in revenue from this region climbing from $38 million to $63 million — a remarkable 65% increase year-over-year.

Meanwhile, Europe’s ARPU grew by 26% to approximately $1.30, and the U.S.&Canada saw a 6% increase, reaching $7.29.

Conclusion

In after-market trading price of a stock dropped from $39 and is now bouncing around $35.

From my perspective this reaction seems to reflect investors expectations to see stronger results from company; but, I am not seeing any bigger trouble in front of the Pinterest. The combination of rising ARPU and solid user growth, especially heading into the next two quarters, sets the stage for potentially strong performance.

Best quarter for Pinterest is Q4 and with this amount of users it should be record high, it is still hard to say will it pass $1.3 billion mark, but with todays quarter this target doesn't seem out of reach.

Last but not least, CEO highlighted that Gen Z is using Pinterest more than ever. Now making around half of a user group. This is great thing to hear, especially since one of my earlier concerns was whether Pinterest could stay relevant with younger generations. This shift is a strong signal for the platform’s long-term health.