Starbucks Stock Analysis 2025: Brian Niccol's Turnaround Is Real – But Not Enough Yet

Starbucks delivered its best quarter ever in Q4 2025 under Brian Niccol, but store closures, China struggles vs. Luckin Coffee, worker unrest, and a sky-high P/E keep me on the sidelines. Full analysis.

Around the time Brian Niccol became CEO of Starbucks, I was diversifying my portfolio by investing more heavily in the non-alcoholic beverage industry. At that point, I had four stocks on my radar: Coca-Cola, PepsiCo, Monster Beverage, and Starbucks. Although I put money into the first three, I wasn't convinced the new CEO could turn around Starbucks' trajectory quickly enough to justify jumping in right away - so I decided to hold off.

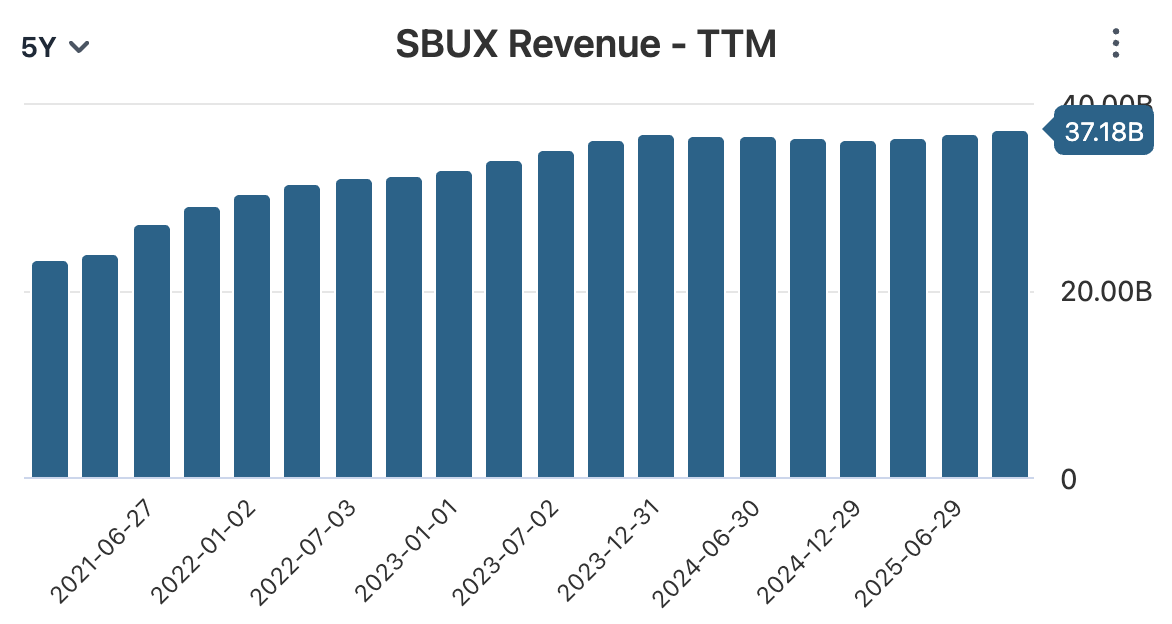

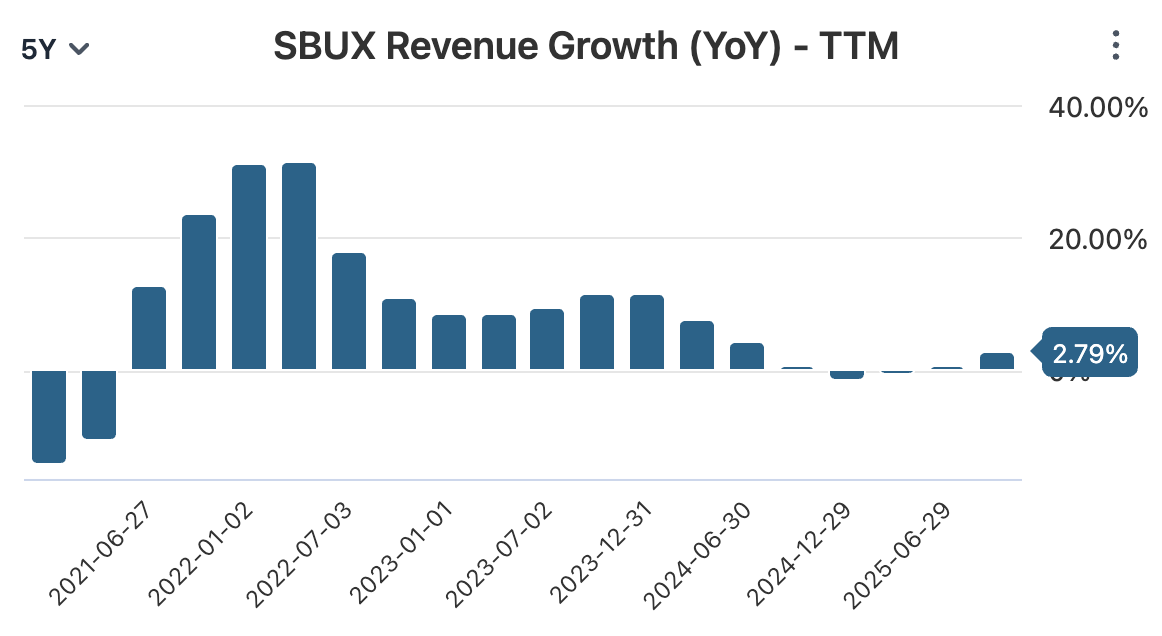

Even though Q4 2025 marked Starbucks' best quarter in company history - and the CEO's financial report tries to build hype around it - it's clear the "Back to Starbucks" initiative will need several more quarters to regain solid footing, at least financially. After all, it took a full year just to reverse declining trend.

Starbucks Revenue TTM and Growth - DATA: stockanalysis.com

All the while, the company is shuttering a significant number of company-owned stores in North America - about 400 in total. While licensed and international store counts are rising, they're not enough to push overall openings into positive territory. Given that most revenue still comes from North America, where sales have remained essentially flat over the past three years (despite global inflation), it's no surprise Starbucks has lost touch with its core customers.

China Nightmare: Luckin Coffee Is Eating Starbucks’ Lunch

In China - one of Starbucks' biggest hopes for new revenue streams—the company is facing major headwinds. Its primary rival, Luckin Coffee, boasts three times as many stores, with prices about one-third of Starbucks'. In this tough market, where coffee hasn't yet gone massively mainstream like it has in the West, Starbucks is struggling to gain traction. Luckin grab-and-go convenience is big factor for China costumers, while Starbucks sit-down experience still didn't catch in China - which drives up operating costs and hinders expansion in the region.

And that's far from the end of Brian Niccol's troubles: Worker protests have intensified in recent days, and it's clear the CEO-to-worker pay ratio of 6,666-to-1 -the highest in the S&P 500 - is doing little to keep baristas happy. Starbucks sells an "experience" alongside its beverages, after all. How premium experience we can expect from a so-called luxury brand that's underpaying its frontline staff?

Conclusion

Given all this, I'm sticking to my original plan: Wait for the next one or two earnings reports before reconsidering. The P/E ratio remains sky-high (above 50) for a company struggling with stagnant growth in North America and China. And right now, it doesn't seem like management has a clear roadmap for revitalizing the brand. Stiff competition in a key market like China, plus internal issues with workers and customers drifting toward more affordable coffee options, present formidable challenges - especially when they all hit at once.