Value Investing: Dividend Stocks to Watch and Invest in During 2026

Here’s my list of reliable and future-proof dividend stocks that I’ve invested in and plan to keep adding to for long-term income growth.

Many investors believe that the best dividend stocks are those with the highest average dividend yield over the last 5 or 10 years. My approach is different. While owning a stock with a dividend yield above 10% may sound ideal (and yes, such stocks do exist), they often end up losing market value over time. In many cases, these companies cannot sustain such payouts and eventually cut the dividend - leaving investors with losses on two fronts: income and capital.

My approach to dividend investing can be described in a few simple and easy-to-follow steps:

- The company must have at least 15 years of consistent dividend payments

- Dividend yield should be at least 2.1%

- The dividend should increase every year

- The company should operate a stable business with a strong economic moat

Dividend Stocks That Fit My Long-Term Criteria

In this section, I highlight companies that align with my dividend investing approach. Each of these stocks meets my core requirements: a long history of dividend payments, sustainable yields above 2.1%, consistent dividend growth, and a stable business supported by a strong economic moat. These are not high-yield bets, but long-term income generators I consider suitable for a durable, passive dividend portfolio.

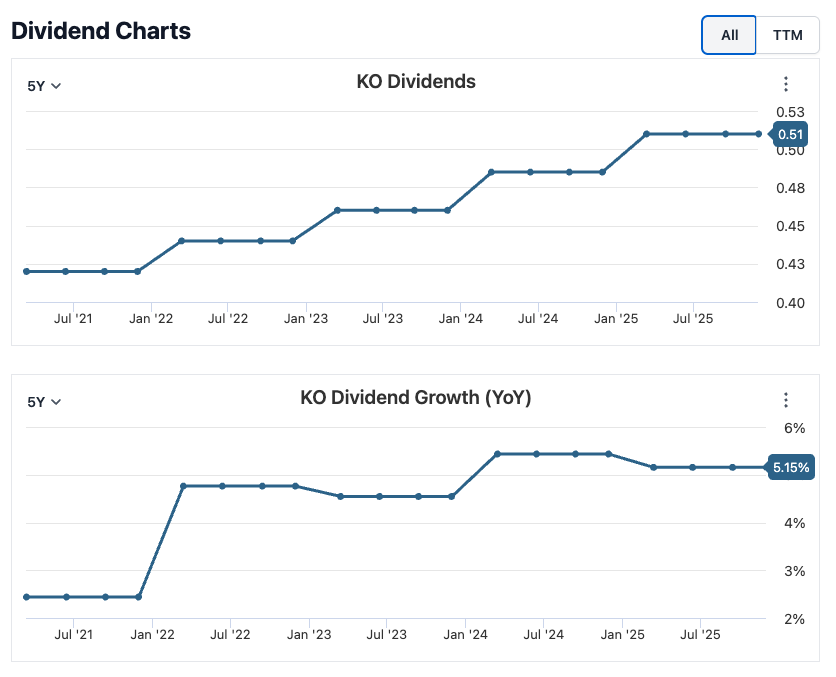

The Coca-Cola Company (KO)

Coca-Cola is a textbook example of a dividend stock that fits my criteria and is also the first stock I bought for my passive portfolio. The company has paid and increased its dividend for more than six decades, making it one of the most reliable income generators in the market. Its dividend yield comfortably sits above 2.1%, supported by stable cash flows and one of the strongest consumer brand moats in the world. With global distribution, pricing power, and predictable demand, Coca-Cola offers dividend investors both stability and consistency.

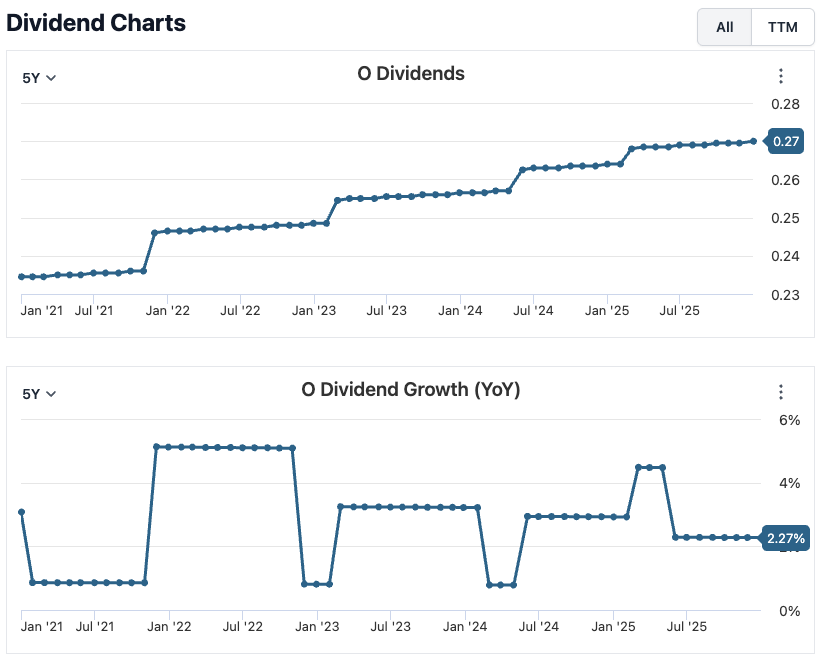

Realty Income (O) - monthly dividend company

Realty Income stands out as one of the most dependable dividend payers in the REIT space. With decades of uninterrupted dividend payments and a track record of regular increases, the company has built its reputation around predictable income. Its diversified portfolio of high-quality tenants and long-term triple-net leases provides stable cash flow, supporting a healthy dividend yield above 2.1%. Realty Income’s business model and scale create a durable moat that aligns well with long-term dividend investing.

The company is best known as a monthly dividend payer, producing stable and scalable income, which opens opportunities for a powerful snowball effect over time. As an added bonus, from my perspective, this stock currently shows a solid Buy signal.

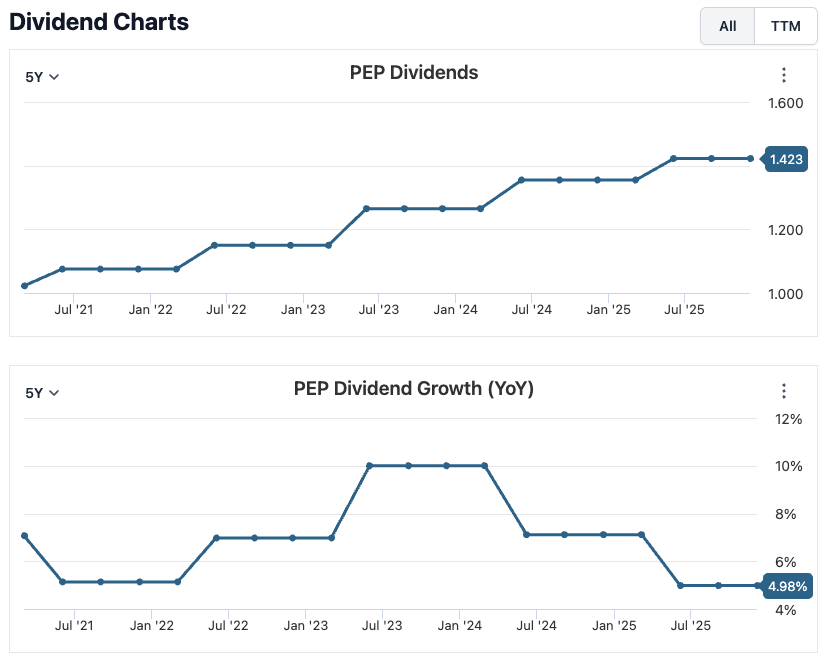

PepsiCo (PEP)

PepsiCo combines a long dividend history with a diversified and resilient business model. The company has increased its dividend for over 50 consecutive years, backed by strong free cash flow and a yield comfortably above 2.1%. Unlike many peers, PepsiCo benefits from both beverage and snack segments, providing diversification and pricing power. This balance, combined with powerful global brands, creates a strong economic moat that supports long-term dividend growth.

PepsiCo is one of the companies I prefer to think of more as a “bond” than a traditional equity, which is important because I buy dividend stocks primarily for their longevity.

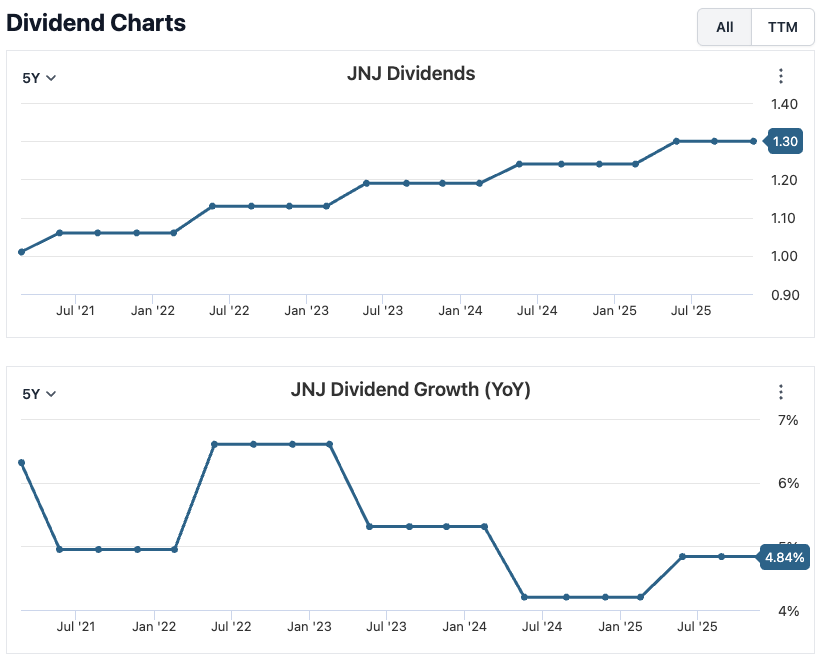

Johnson & Johnson (JNJ)

Johnson & Johnson represents one of the strongest dividend profiles in the healthcare sector. With more than half a century of consecutive dividend increases, the company demonstrates great financial discipline and stability. Its diversified operations across pharmaceuticals, medical devices, and consumer health help smooth earnings cycles and protect cash flow. This stability, combined with a durable competitive moat, makes Johnson & Johnson a core dividend investment for long-term investors.

STAG Industrial (STAG)

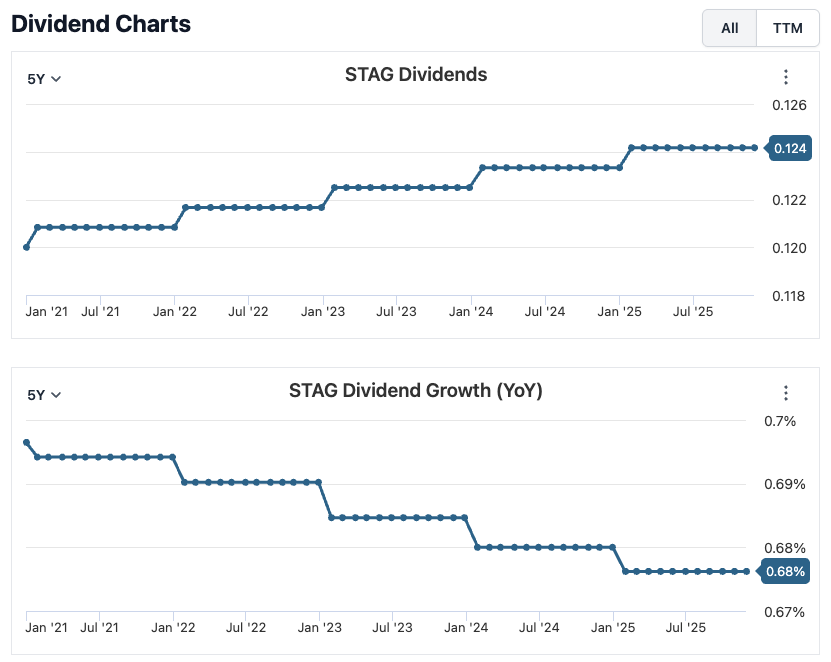

STAG Industrial offers exposure to the industrial real estate sector with a clear focus on income stability (they are renting their properties to some of the industrial giants, like Amazon, FedEx, UPS, DHL and others). The company benefits from long-term leases and growing demand for logistics and warehouse space, which supports consistent cash generation. While its dividend history is shorter than some classic dividend aristocrats, STAG has demonstrated commitment to sustainable payouts and gradual dividend growth. Its specialized niche and disciplined capital allocation make it an attractive dividend holding within the REIT segment.

STAG also pays dividends to investors on a monthly basis, while dividend increases are implemented on a yearly basis.

Stocks With Future Dividend Potential

While some companies do not yet meet all my strict dividend criteria, I still consider them worthy additions to my portfolio because of their strong cash flow, durable business models, and capacity to grow dividends in the future. These are companies that, over time, could evolve into perfect dividend stocks and become reliable income generators.

Apple (AAPL)

Apple started paying dividends relatively recently, but I see it as a company with massive free cash flow and a business model capable of supporting substantial dividend growth and buybacks over time. As the company continues to mature, its combination of cash generation and shareholder returns could make it a strong long-term source of income.

Mastercard (MA)

Mastercard currently pays a modest dividend, but its dominant position in the global payments industry and consistent revenue growth make it a potential future dividend champion. With scalable cash flow and disciplined capital allocation, it has the tools to steadily increase payouts for years to come.

Costco (COST)

Costco has a smaller dividend compared to classic dividend aristocrats, yet it boasts a loyal customer base, subscription model, and resilient cash flow, all of which support the potential for future dividend growth. Over time, this could transform Costco into a strong, reliable income stock.

Dividend investing has been a huge part of how I build long-term wealth, and these stocks are my favorites for steady income and future growth. I’d love to hear from you - what dividend stocks do you hold or follow?