Why Fast Food Growth is Slowing: Health Trends, Gen Z, and Market Saturation

Fast food was the poster child of affordable, reliable dining. Today, even McDonald’s faces challenges as health trends, Gen Z habits, and market saturation.

For decades, fast food was synonymous with affordable convenience. However, the industry has begun to show clear signs of stress. Once considered a consistently growing, almost recession-proof business, fast food companies are now navigating a far more harsh environment. Today, even some of the strongest players are delivering only marginal revenue growth while facing significant structural headwinds.

In this research, I analyse several core publicly traded players such as McDonald’s, Chipotle, and Domino’s, alongside newer names like CAVA and Texas Roadhouse. I also include Starbucks in the mix - while not a traditional fast-food company, it operates one of the world’s most recognisable and influential franchise models, making it relevant to this discussion.

The goal is to understand whether these challenges are cyclical - or signs of a deeper shift in consumer behavior and market saturation.

Revenue growth is narrowing to a few winners like CAVA and Texas Roadhouse

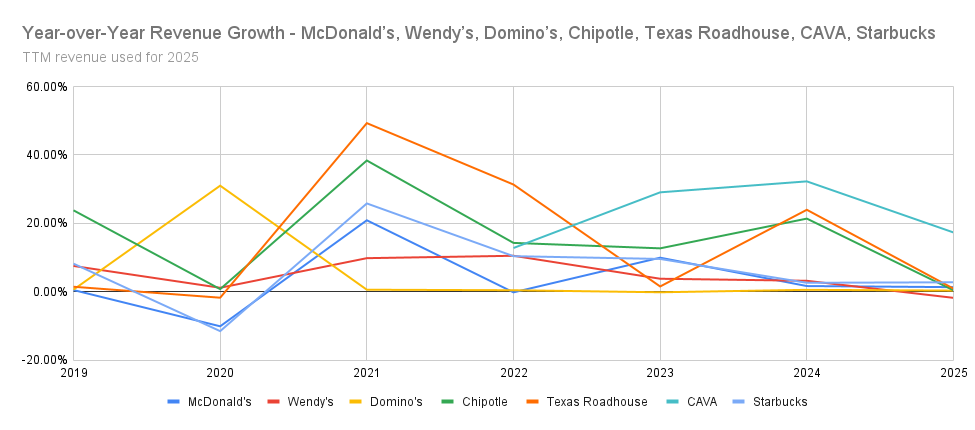

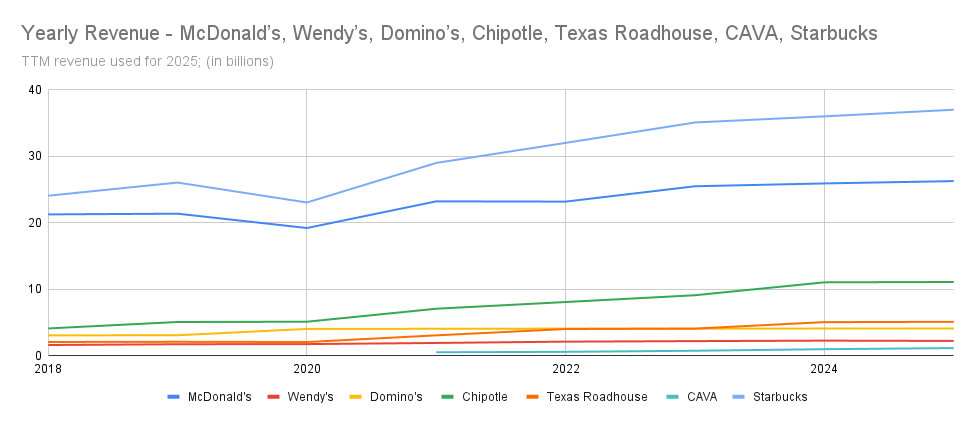

Despite rising menu prices (I will cover this topic in depth later), revenue growth across these companies has clearly slowed since the COVID rebound. The largest players by market capitalization McDonald’s and Starbucks continue to generate stable and predictable revenues, but growth has become stagnant.

Revenue and Revenue Growth in Fast Food industry: McDonald's, Starbucks, Wendy's, Chipotle, Domino's, Texas Roadhouse, CAVA

On the opposite end, smaller and newer chains show a different dynamic. CAVA and Texas Roadhouse stand out as the only companies in this group still delivering visible and consistent revenue growth in recent years. Starting from a smaller revenue base, both have benefited from store expansion and a concept that resonates better with current consumer preferences.

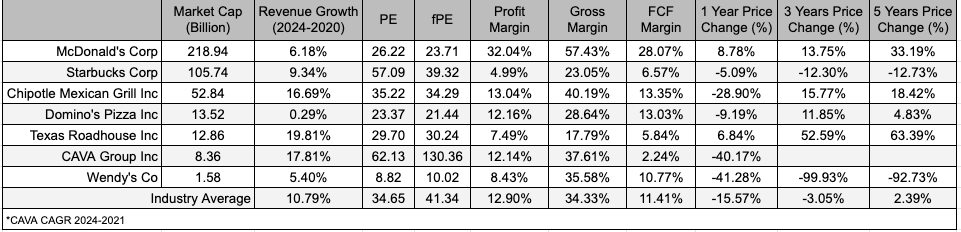

It is interesting to compare these companies side by side. Many of them have seen meaningful declines in their stock prices. The largest drawdown occurred at Wendy’s, whose shares now trade at the lowest valuation in the group, with a P/E ratio of 8.82 compared an industry average of 34.65.

At the same time, revenue growth over the past five years has been relatively modest across the sector. McDonald’s, Wendy’s, and Domino’s in particular have delivered mid-low single-digit annual revenue growth (CAGR), reinforcing the idea that slower top-line expansion is a key factor behind weaker stock performance.

Meanwhile, on a positive note, Texas Roadhouse stands out for both revenue growth and stock price performance, even though its profit, gross, and free cash flow margins remain below the industry average. Despite these lower margins, the company continues to trade at elevated P/E and forward P/E multiples, signaling that investors value its growth potential and operational consistency over margin strength. In other words, the market is willing to pay a premium for reliable expansion, even without best-in-class profitability. This is something established players can’t compete with, as their stockholders expect high dividends and large margins.

Structural changes reshaping fast food companies

In this section, I break down the key structural forces reshaping the fast-food industry and explain why growth has become increasingly difficult for most publicly traded chains.

Inflation has Redefined "Cheap" in food industry

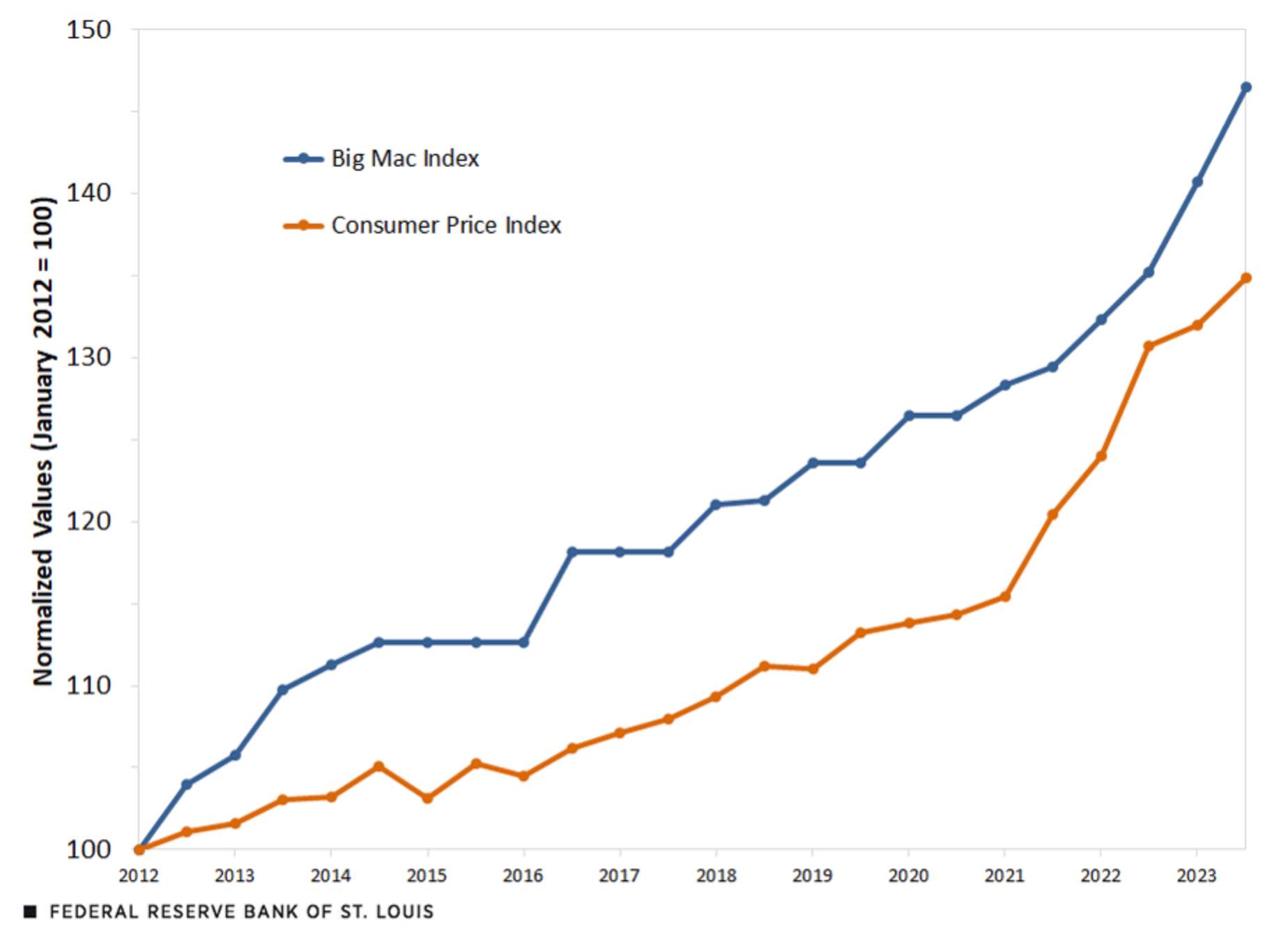

One of the most significant forces reshaping fast-food economics is inflation. In practice, fast-food menu prices have risen faster than the broader Consumer Price Index (CPI). While part of this increase can be justified by higher input costs, such as labor, energy, and commodities, inflation alone does not fully explain the magnitude of price hikes.

Minimum wage increases have clearly pressured operating costs, particularly in labor-intensive restaurant models. In several cases, higher prices were accompanied by shrinkflation - term which is explaining smaller portion sizes. As a result, inflation has not only raised prices, but fundamentally altered consumer perception.

One useful way to understand how inflation has affected fast food is through the Big Mac Index, indicator created by The Economist. The index tracks the price of a Big Mac across countries as a simple, real-world proxy for consumer inflation and purchasing power, since the product uses a consistent basket of inputsbeef, bread, labor, rent, and energy. In recent years, however, the price of a Big Mac has risen significantly faster than the broader Consumer Price Index (CPI). Between 2020 and 2024, the average U.S. Big Mac price increased from roughly $5.71 to $7.29, a gain of about 27%, while overall consumer inflation and wage growth rose at a meaningfully slower pace.

This divergence highlights a key problem for the fast-food industry: when its flagship product inflates faster than general consumer prices, fast food loses its core advantage as an affordable everyday option.

Health consciousness is creating clear winners

Rising health awareness among consumers has become a meaningful differentiating factor within the fast-food landscape. While traditional quick-service restaurants continue to rely on heavily processed, calorie-dense menus, chains positioned as “healthier” or higher-quality alternatives have seen materially stronger growth. Chipotle and CAVA stand out in this regard. Over the past five years, Chipotle has delivered approximately 17% annual revenue growth (CAGR), while CAVA has grown revenues at an even faster pace of roughly 18% CAGR, despite operating from a much smaller base.

This trend is further amplified by the growing popularity of GLP-1 drugs, which are driving increased consumer focus on nutrition, weight management, and overall wellness. As more people adopt these treatments, demand for meals that complement healthier lifestyles is rising.

Gen-Z consumes food differently

Gen Z is reshaping the fast-food and casual dining landscape with new priorities: they want visually appealing, Instagram-worthy meals and convenient, on-demand options. In short, they prioritise experiences over just “food.”

Chains like Chipotle and CAVA thrive because their menus are photogenic, customizable, and aligned with the health-conscious mindset of younger consumers. Delivery platforms like DoorDash also dominate over traditional dine-in, reflecting a generational shift toward speed and convenience.

While researching delivery trends, I can hardly blame anyone for choosing takeout over a full dine-in experience. The high cost of restaurant menus, combined with high-value expected tips is becoming too expensive; at the same time eating food at home while watching Netflix is much more comfortable.

Market Saturation is real and Competition is increasing

As discussed in the article, established chains like McDonald’s and Wendy’s are increasingly being challenged by newer companies offering higher-quality ingredients and more flexible dining options. At the same time, most cities are already saturated with fast-food restaurants. Some of the highest state-level densities are in Alabama, with 6.3 fast-food restaurants per 10,000 people, while certain city-level analyses report up to 13.3 per 10,000. These numbers continue to rise year over year, making the competitive landscape even more challenging for well-established brands.

Conclusion

The U.S. fast-food market is clearly saturated and with strong headwinds to battle. Many key players are trying to win by offering steep discounts through their apps, which can be seen as an implicit acknowledgment of past pricing missteps. Meanwhile, newer competitors are gaining ground by focusing on taste (like Texas Roadhouse) or health-conscious, high-quality offerings, such as CAVA and Chipotle.

From an investor’s perspective, I’m not ready to buy any particular stock just yet. While the idea of adding CAVA, Texas Roadhouse, or Chipotle together as a more “stable” position is on my mind, I plan to wait until mid-2026 before making any decisions.

For sure, I’ll write about this on the blog, so feel free to subscribe to stay updated. In the meantime, you can check out my in-depth analysis of Starbucks by clicking here, it’s a deep dive into one of the most interesting players in the space.