Why Monster Beverage Is a Top Pick for Value Investors

Monster Beverage continues to grow globally, backed by strong brands and a Coca-Cola partnership. Discover why value investors see pricing power, margins, and market reach as key drivers of long-term growth.

If someone asked you to name a stock that has delivered a steady ~11% annual price growth over the past decade - compounding to roughly 194% in total - while operating in almost every corner of the world, a beverage company would likely not be the first answer. Yet Monster Beverage is exactly that.

Monster Beverage is a global leader in the energy drinks market, with a diversified and expanding brand portfolio that includes Monster Energy, NOS, Full Throttle, Burn, Mother, Predator, and others. Its products are widely distributed and deeply embedded in consumer habits across multiple regions.

As investors have recently been reallocating capital away from large technology companies and traditional high-growth stocks toward more predictable and trackable industries, this shift creates an interesting opportunity. In this context, Monster Beverage stands out as a compelling candidate for a value-focused review.

Monster Beverage is Raising Prices Without Losing Costumers

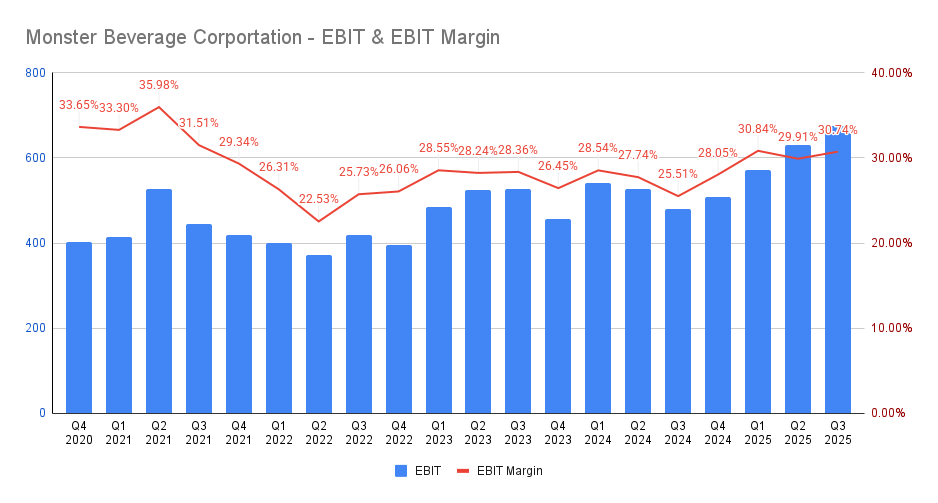

While revenue growth is always a positive signal, and Monster Beverage continues to grow sales quarter after quarter, I believe it is more important to focus on net sales growth and operating margins. In the most recent quarter, the company reported a 40.7% increase in operating income, while net sales grew by 16.8% over the same period.

This difference suggests that Monster successfully implemented pricing adjustments while maintaining strong consumer demand. In other words, the company raised prices and customers continued to buy its products (often in even greater volumes) highlighting both pricing power and brand strength.

Monster Beverage Gross Profit; CAGS; Gross Maring and EBIT & EBIT Margin data: daaninvestor.com

For the same reasons, gross margin expanded to 55.7%, up from 53.2% a year earlier, representing an improvement of more than three percentage points. Another key metric closely watched by value investors is Earnings Before Interest and Taxes (EBIT). Here again, Monster delivered strong results, increasing EBIT to $2,385 million, up from $2,007 million the previous year. As a result, the EBIT margin improved to approximately 30%, compared with around 27% a year ago.

Market Positioning and Competitive Advantages

As a leading global player in the energy drink market, Monster Beverage operates across all continents, with its flagship Monster Energy brand particularly popular among Millennials and Gen Z. This strong brand recognition builds a durable economic moat, which is difficult for competitors to disrupt; especially in a habit-driven category like energy drinks.

A key strategic advantage for Monster is its partnership with The Coca-Cola Company, which holds roughly a 20% stake in the business. Beyond equity, Coca-Cola provides access to its global distribution network, helping Monster scale efficiently while maintaining independence in brand management and product development. This partnership represents a crucial rule in the company’s operational efficiency and competitive position.

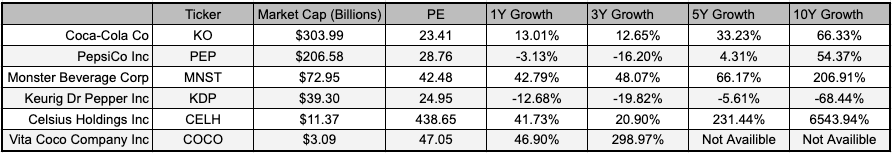

When comparing Monster to its peers, the company’s growth is impressive for its size. Despite having a market capitalization of only about 30% of PepsiCo’s, this is surprisingly high given that Monster is a single-category energy drink company.

Conclusion

With a PE ratio around 43, Monster Beverage is on the pricier side compared to the broader market. However, given its strong market position, global brand recognition, and strategic advantages, it stands out as one of the better companies in beverage sector.

From a value-investing perspective, my approach would be to wait for a slight pullback in price, but the long-term outlook remains strong. Monster appears to be a steady-growth company, with potential to maintain similar growth rates as in the past. My projected target price is around $100, though achieving this target may take 2–3 years.