Why Pinterest Stock Dropped After Record User Growth - PINS Q4 2025 Earnings Review

Pinterest added more users than ever, yet the stock is down. Growth looks great, but something is slowing behind the scenes in its most important market. Here’s the real story investors need to know.

Pinterest shares dipped as much as 20% after the company reported its Q4 2025 results. At first glance, the numbers don’t look dramatic. Revenue came in at $1.32B, missing estimates of around $1.33B by just 0.77%. EPS was reported at $0.67 versus expectations of $0.68. This doesn’t look like the kind of financial report that should wipe 20% off a company’s value in a single after-hours session.

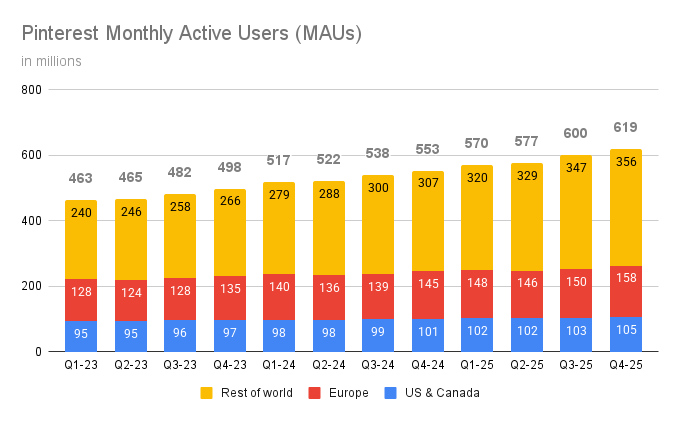

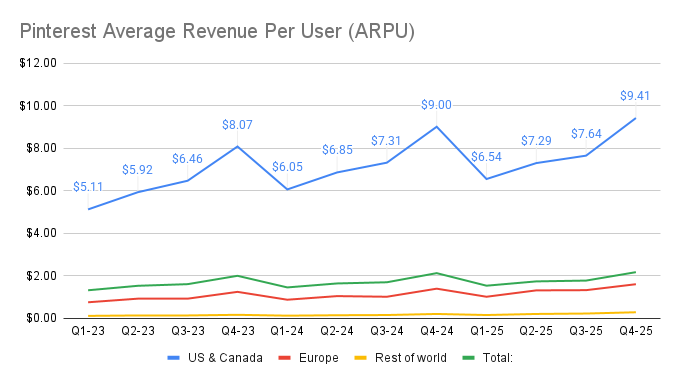

Monthly Active Users (MAUs) and Average Revenue Per User (ARPU) both Increasing but US & Canada Growth Slows

In the report, Pinterest showed that Monthly Active Users reached an all-time high of 619 million. Contrary to the belief that growth in US & Canada is over, the company added another 2 million users in that already saturated region, bringing the total to around 105 million. Europe and Rest of World also increased and are both on the record level.

Overall, MAUs grew 12% YoY which is slightly accelerating compared to 11% growth in Q4 2024.

At the same time, Average Revenue Per User increased across all regions. US & Canada remain the clear leader with ARPU of $9.41, while Europe stands at $1.59 and Rest of World at $0.27. Blended ARPU came in at $2.16, higher than in the same quarter last year.

So what is the real concern, and why did the stock lose 20% overnight? The answer lies in the growth of ARPU in the US and Canada. Investors were expecting much stronger monetization in the company’s most profitable region, especially at a time when user numbers are reaching record levels. Instead, ARPU growth in US and Canada slowed from 12% in Q4 2024 to roughly 4% in Q4 2025. That kind of deceleration in the core market is difficult to ignore.

That deceleration is hard to ignore.

The reasons were addressed during the earnings call by CEO Bill Ready and CFO Julia Donnelly:

However, we are not satisfied with our Q4 revenue performance and believe it does not reflect what Pinterest can deliver over time. While we absorbed an exogenous shock this year related to tariffs, disproportionately affecting ad spend from our top retail advertisers, this quarter also underscored where we need to move faster.

- Bill Ready CEO

We believe this pullback on ad spend from larger advertisers was felt across the industry, but impacted our platform to a higher degree given our current revenue mix. We also saw a second-order effect of the same dynamic into Europe as well, with some of these same large global retailers pulling back on spend in Europe as they rebalance across their global portfolio.

- Julia Donnelly CFO

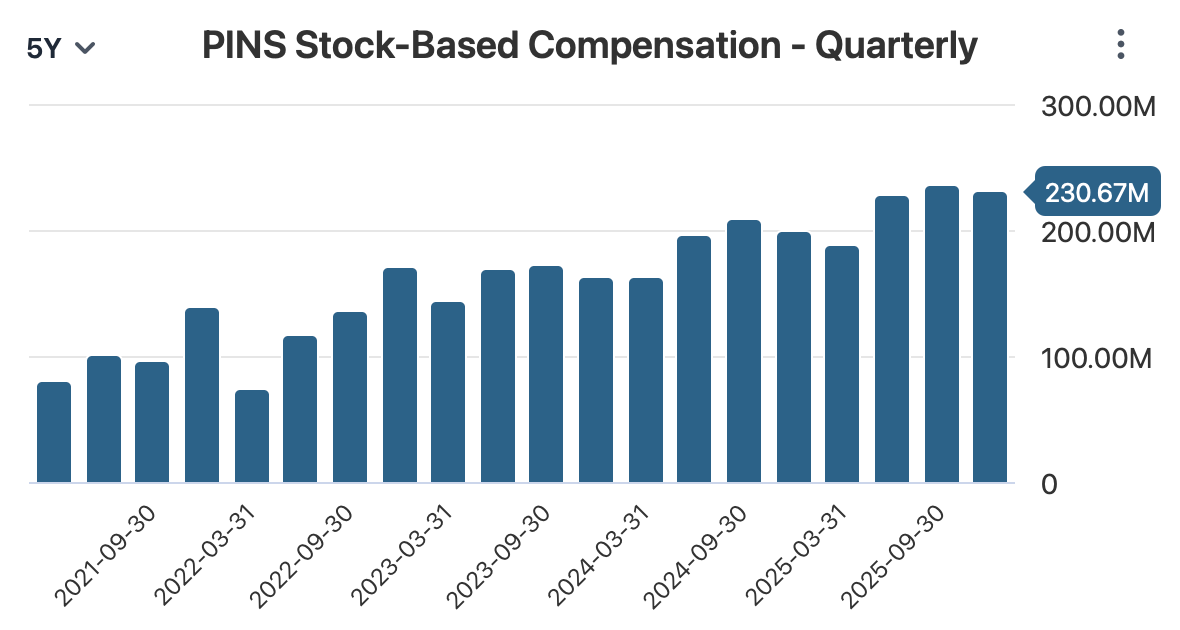

Stock Based Compensation is impacting liquidity too much

For readers who may not know, Stock-Based Compensation is a way of paying employees, executives, and directors with shares instead of cash. It is a common tool to reward performance and align employees with long-term company success.

While most analysts argue that Stock-Based Compensation should not be deducted from Free Cash Flow because it is a non-cash expense. I disagree.

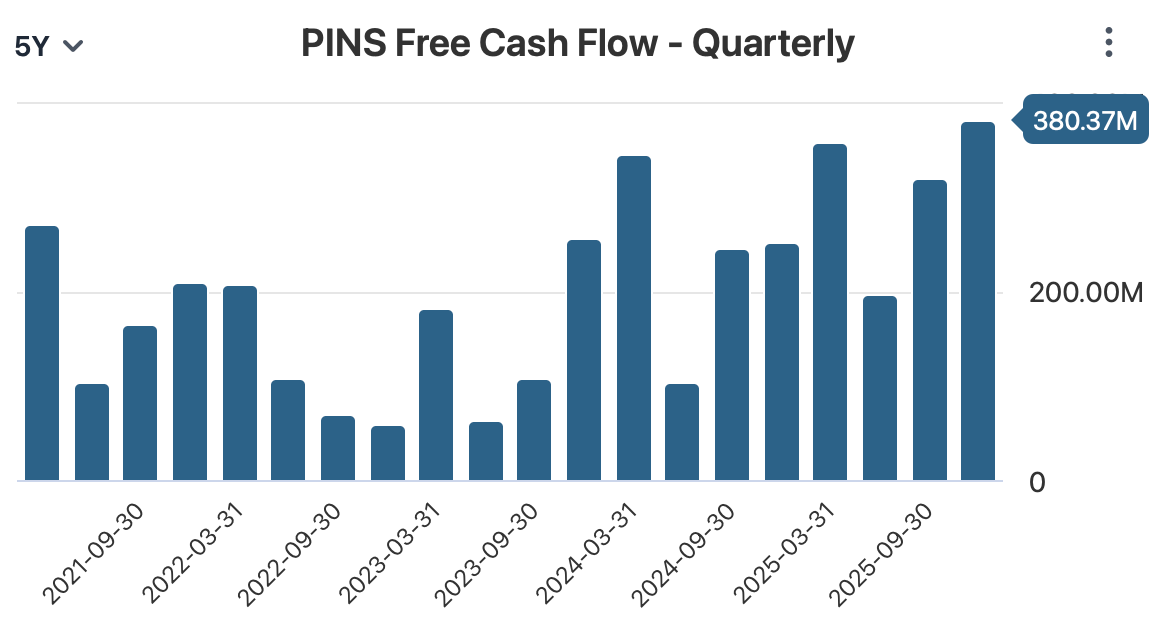

Free Cash Flow is one of the most important metrics when valuing a business. In the case of Pinterest, FCF has been increasing quarter over quarter, which is always encouraging to see.

However, the problem appears when we look deeper. Even though SBC is not a direct cash expense, it is still a real economic cost. It dilutes shareholders and affects the company’s liquidity over time. When compensation is consistently paid out in equity, ownership is quietly transferred away from existing shareholders.

If you compare SBC to Free Cash Flow, it becomes clear that SBC remains high and relatively stable, even in periods when FCF growth slows. In percentage terms, the level of compensation looks heavy relative to liquidity generation.

In my view, this is where capital allocation needs adjustment. Reducing SBC and introducing a dividend program would send a strong signal to shareholders. I want to be clear here.. I am not against Stock-Based Compensation, but shareholders also need to feel rewarded for holding the stock.

And timing matters. The stock is trading near historical lows and below its IPO price. If management wants to rebuild confidence, this would be the right moment to act.

Conclusion: Still Bullish, but Patience Is Limited

If you’ve read my previous posts about Pinterest, you know I have been consistently bullish on this company. It is a story I genuinely like and believe in. The platform offers inspirational and creative content that you simply cannot find on other social networks.

However, lately it feels like management has lost clarity. Not only clarity about the long-term vision, but also about execution. Leadership confidence matters, especially during difficult periods. Firing engineers for asking internal questions does not signal strength. It signals instability. And that is concerning at a time when the company is already under pressure.

In simple words, there is serious work ahead for management. Investors who have been in this stock for years want to see tangible improvements. With such a strong and growing user base, ARPU should be moving in a much more convincing direction.

My plan is simple. I will give the company one or two more quarters. If we do not see clearer strategic direction and stronger monetization trends, it will be time to reallocate capital elsewhere.